Liquidity, currency

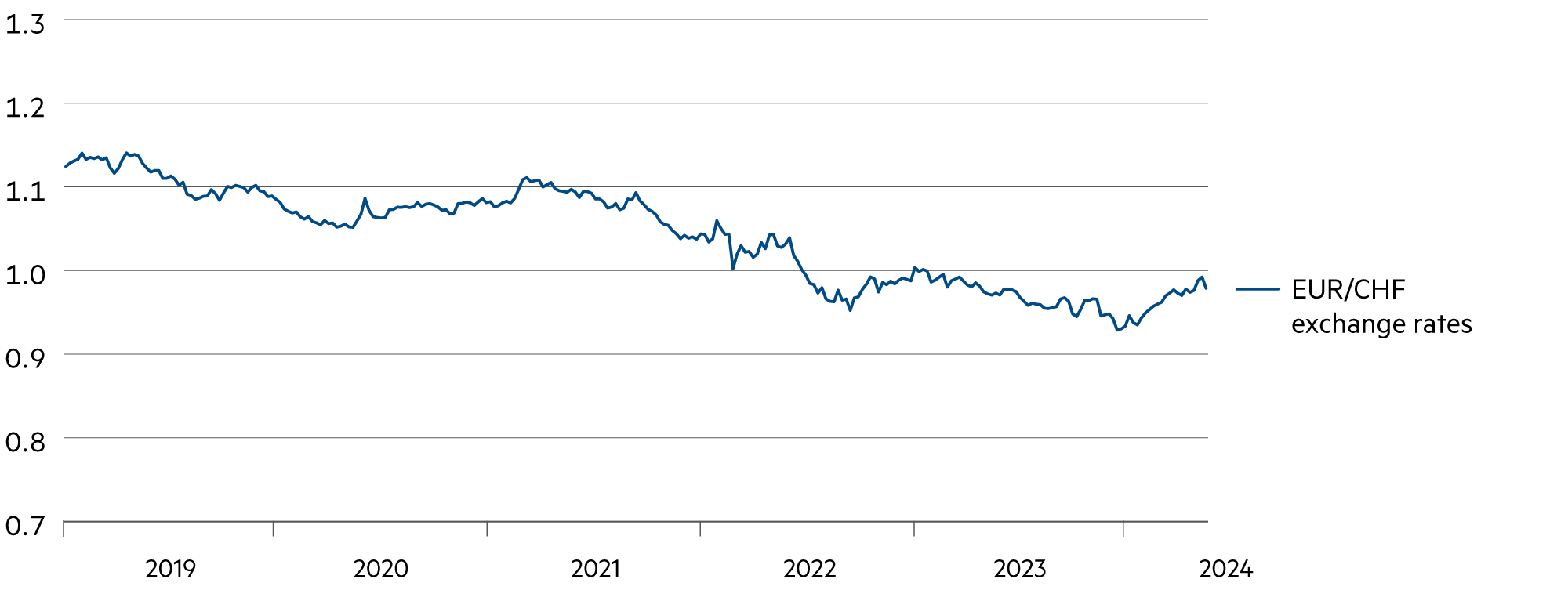

The euro remains on a downward trend

From the Swiss perspective, the euro has appreciated by 5.4% against the franc in the year to date and, at 0.98, is back at the same level as in spring 2023. However, the structural downward trend remains. The economic recovery in the eurozone is certainly helping the currency temporarily. On the other hand, the franc remains relatively weak in the current year after the steep appreciation in the previous year, which is also a consequence of the Swiss National Bank’s monetary easing.

Read more Close

In the eurozone, investors have been accumulating “cash” in the form of short-term fixed-term deposits over the last 18 months, attracted by the combination of higher interest income and very low risk.

There is currently almost a trillion euros in European retail deposits that will mature by the end of the year. This huge amount of money needs to be reinvested – but with what return prospects and in which asset class?

The inflation trend in the eurozone remains clearly downward, and interest rates are likely to move in the same direction. It is becoming increasingly unattractive to remain fixed in time deposits. This is because overall inflation is approaching that of Finland (+0.5%) and Italy (+0.8%). The time was ripe for a first interest rate cut on June 6. This sent a strong signal to the trade unions, which have been able to push through higher collectively agreed wages in times of high inflation.

At present, the European Central Bank’s (ECB) experimental wage indicator known as the “wage tracker” suggests that wage pressure in the eurozone is decreasing. With a less restrictive course, the ECB can also confirm the expectation of declining inflation.

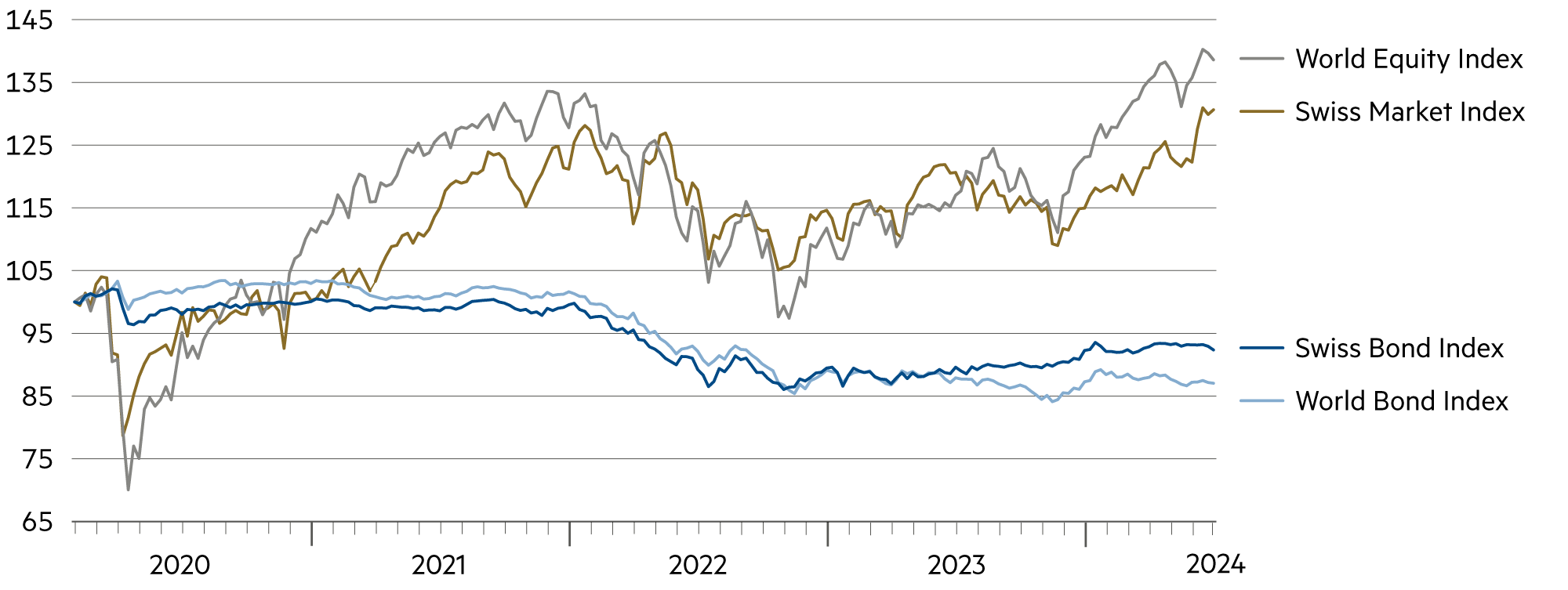

Given this mix of macroeconomic data and monetary policy considerations, it is time to shift fixed-term deposits into investments with longer maturities and higher cash flows, which can offer relatively attractive (nominal and real) yields as interest rates fall.

These are, for example, longer-term corporate bonds, which are currently less volatile. In addition, this bond segment in Europe has impressively low default rates, even in a weak economy. If the outlook improves, it should become even more attractive to hold corporate bonds with a historically attractive risk premium in the portfolio.

As interest rates fall, real investments with stable cash flows will also experience higher valuations in the medium term. So far, valuations are still under pressure from high interest rates (and correspondingly high discount rates). The higher potential at lower interest rates typically relates to dividend-bearing shares of high-yielding companies, which is inherently associated with a favorable risk/return ratio.

We also include infrastructure stocks in this category. If a company such as Zurich Airport achieves disproportionately high earnings growth in the coming years, this is even particularly advantageous – especially in comparison with the commercial real estate segment.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

Inflation (+1.4% in May yoy) remains within the SNB's target range. This raises hopes that the SNB will cut key rates again on June 25. |

| Euro / Swiss franc |

|

|

The ECB's future interest rate path is likely to be “gradual”, i. e. at a pace of quarterly steps rather than from meeting to meeting. |

| US dollar / Swiss franc |

|

|

At 0.90, the dollar is currently around 0.9% lower than a year ago. However, this small change was associated with high fluctuations in the meantime. |

| Euro / US dollar |

|

|

Despite significantly lower interest rates, the euro gained 3.1% against the dollar last year. New debt in the USA is horrendous. |