Asset management of your occupational pension plan (BVG)

We support small and medium-sized enterprises in managing their occupational pension plan funds. In doing so, we take the company’s starting situation into consideration and rely on an independent analysis, active management, and a strong domestic focus.

The return as an important contributing factor

For small and medium-sized enterprises, occupational pension plans and the associated choice of pension fund should be more than just a legal obligation. This is because the performance of the pension fund has a much stronger influence on the assets of the insured parties than, for example, a slightly higher salary. When choosing the pension fund, too little attention is often paid to the investment side (savings component) in particular. This is despite the fact that about 75% of the annual premiums go to the savings component. Thus, the pension fund solution is primarily an investment solution – and not an insurance product.

Sample calculation

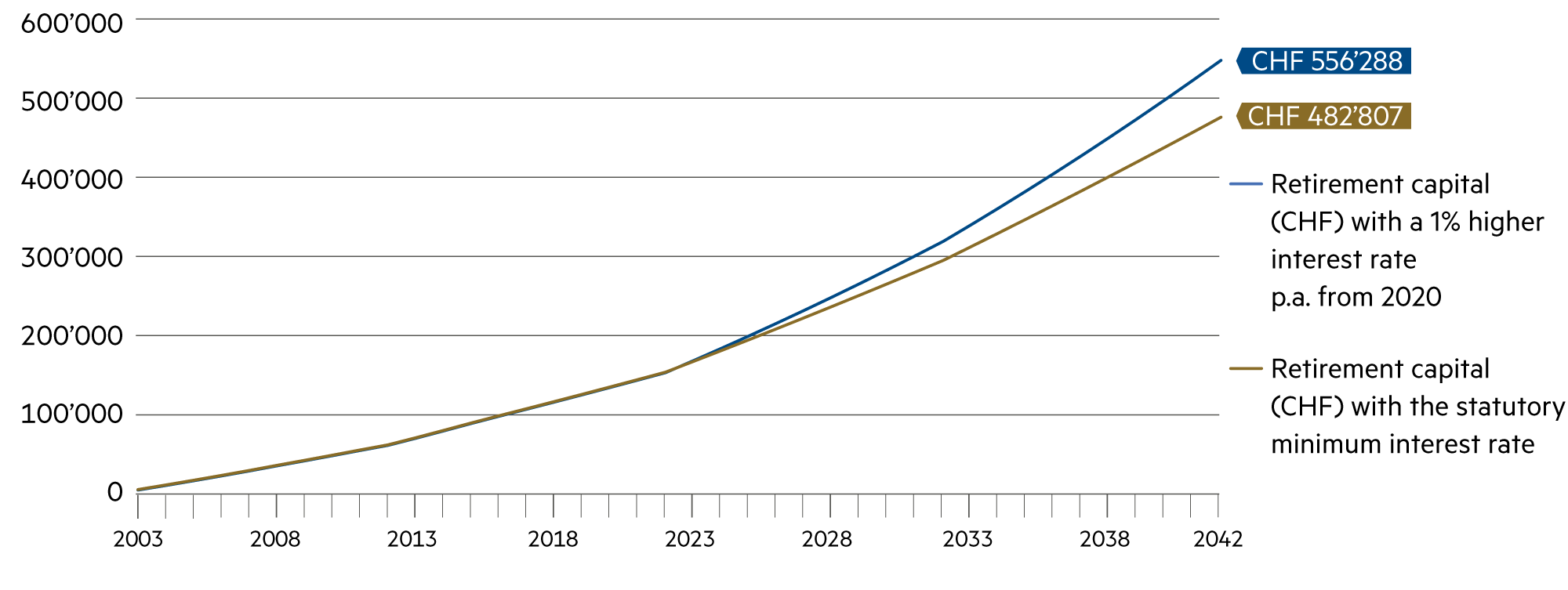

Change in vested pension benefits due to higher interest rates

Starting situation: employee starting in 1978

Insured annual salary: CHF 80,000

A 1% higher annual interest rate on the savings capital (compared to the statutory minimum interest rate) from 2023 onwards leads to an increase in occupational pension plan retirement assets of around CHF 73,000.