Liquidity, currency

The appreciation of the euro comes as no surprise

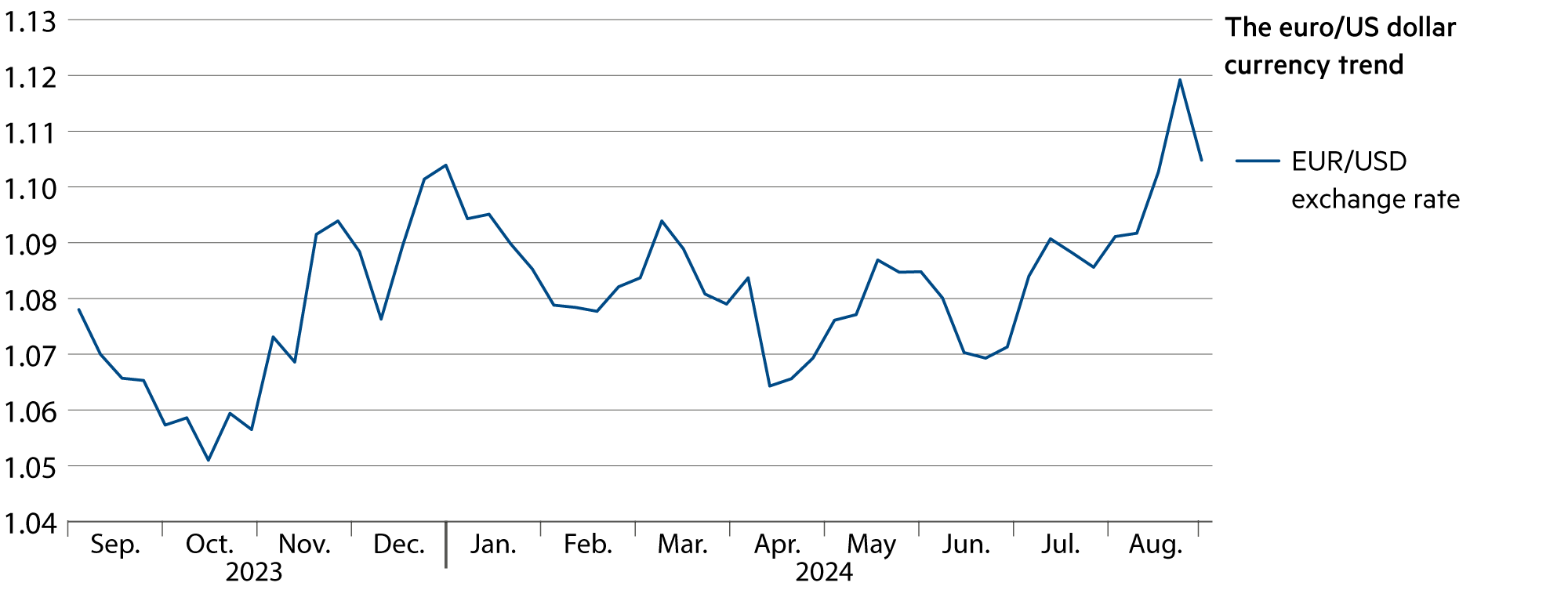

The euro has strengthened against the dollar since the end of June (+3.1%). It seems to have settled above the 1.10 mark for the time being. However, the most important currency pair on the foreign exchange market is debating whether this is a strengthening of the euro or a continued weakness of the dollar. Since its high at the end of April, the dollar has fallen sharply against the franc (-7.6%).

Read more Close

Since June 26, the euro has gained 3.4% against the dollar. The euro has remained fairly stable against the franc. The franc also gained against the dollar. The exchange rate fell from CHF 0.90 to 0.85 (-5.3%) in the corresponding period. This is a subtle indication that it is less a case of euro strength than dollar weakness.

The momentum of dollar weakness could intensify with falling interest rates and declining yields on dollar bonds. Some believe that the dollar cannot weaken any further because interest rate cuts to 3.0% to 3.25% are already priced in. However, the fact is that the dollar is trading at just under 0.82 on the futures market at the end of August 2025 and at less than 0.80 at the end of August 2026.

However, if, contrary to expectations, weak economic data from the US arrives, this could cause the dollar to fall a little further and the euro to appreciate above 1.14. Dollar investments should therefore be treated with a little more caution than euro investments. In Europe, equities with high dividends are competing with bonds, whose yields have already started their downward trend with expectations of interest rate cuts. The less restrictive interest rate and monetary policy of the European Central Bank (ECB) ultimately also ensures fairly stable expectations and explains to some extent the lower currency and share price fluctuations compared to the USA.

The time has certainly come for interest rate cuts in the USA. The exact procedure remains unclear, as does the extent in the coming weeks and months. There is more consensus about the next 12 to 15 months. There are likely to be a total of eight interest rate cuts totaling 200 basis points. However, these firm expectations of interest rate developments have not yet been incorporated into analysts’ discounting considerations. As a result, profit forecasts for 2025/26 are likely to increase significantly as a result of the de facto interest rate cuts, particularly in the non-technology-related corporate sector, and the valuations of real estate and infrastructure investments are likely to be higher.

The most important analysts are fairly unanimous in this medium-term assessment. However, the robustness of the US economy should not be underestimated. The stronger the economic momentum, the less urgent it is for the Federal Reserve (Fed) to act. In the recent past in particular, analysts have misjudged the macroeconomic data in the US and thus raised expectations of the Fed that would not have been appropriate in view of real growth (e.g. annualized +3.0% in the second quarter).

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

Account interest rates are once again tending towards 0% and will again lead to a real loss in value in 2024. |

| Euro / Swiss franc |

|

|

The ECB is likely to cautiously lower its key interest rates further in September. This is unlikely to have any impact on the exchange rate. |

| US dollar / Swiss franc |

|

|

At just under 0.85, the spot rate of the dollar is at a low level due to interest rates and the annualized hedging costs remain high at more than 4%. |

| Euro / US dollar |

|

|

As already mentioned a month ago, the euro has recently made clear gains against the dollar, which could continue until the end of the year. |