Liquidity, currency

Further decline in key interest rates expected

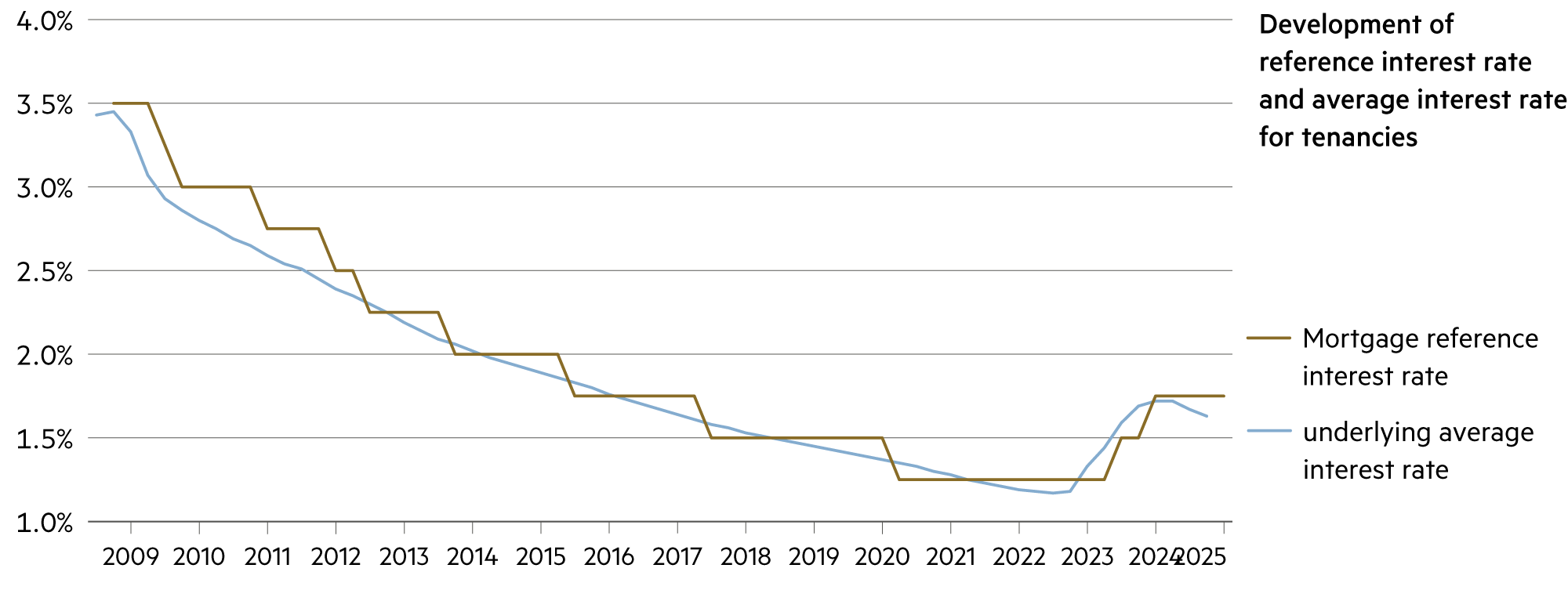

The financial markets expect a further gradual decline in key interest rates. The worst phase of double-digit inflation in the US and Europe is over. It is therefore time to loosen monetary policy, especially in Europe. In Switzerland, key rates, which are currently at 1.0%, could be lowered to 0.5% by spring. The risk of inflation has decreased significantly.

Read more Close

As expected, the European Purchasing Managers’ Indices (PMIs) showed a deterioration in sentiment following the US election result due to the uncertainty surrounding trade policy. Despite the already negative expectations, they were even more disappointing. The composite PMI from the industrial and service sectors was most recently 48.1 (compared to 50 in the estimate).

This highlights a clear risk to Europe’s growth outlook. At least it is reasonable to assume that the European Central Bank (ECB) will cut key interest rates at its upcoming meetings – some well-founded estimates currently put the rate at 1.5% by the end of 2025. Inflation forecasts allow for these cuts. The employment data and GDP outlook make them necessary.

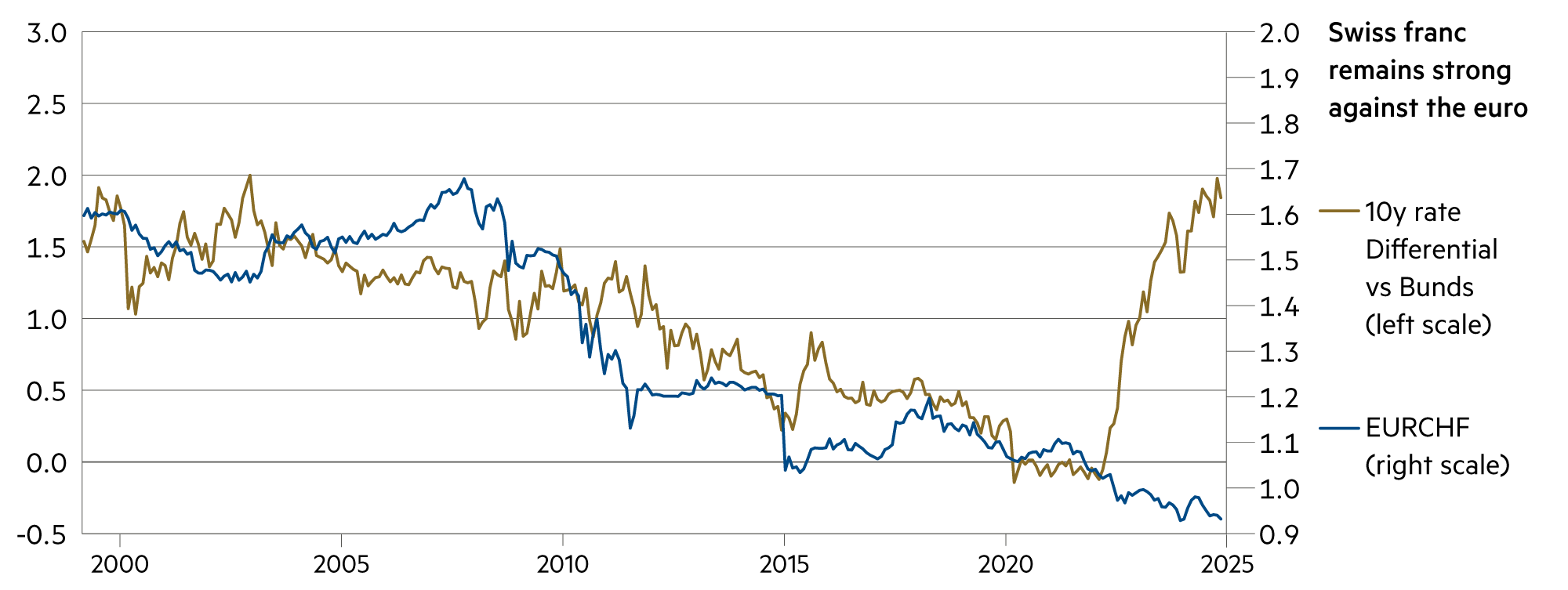

The ECB will have to ease monetary policy substantially, which will also be accompanied by a weakening of the currency. This is how the eurozone can regain some of its competitiveness. However, the greater part must come from a growth-oriented domestic market policy and from a continued increase in productivity in order to be able to more or less keep pace with the framework conditions in the US. The latter requires substantial capital investment over several years, not in roads and bridges, but in modern digital infrastructure and bureaucracy reduction processes.

The risks to growth are getting a lot of media attention, but it also remains to be seen whether there could be a number of positive surprises. Germany also has room to loosen fiscal policy (for intergenerational emergency resolutions on topics such as military defense capability and rail infrastructure). But we assume that appetite will be limited even under a new government. We expect the impact of tariffs to extend to Europe, with trade uncertainty continuing to weigh on sentiment.

It is worth mentioning that Europe is much more exposed to US tariffs than it was in 2016, as the US currently imports more from the EU than from China. Germany and France could also learn from southern European countries, which are growing much faster.

Greece has reintroduced the six-day week, privatized state-owned enterprises and reduced debt after the 2011 sovereign debt crisis. Portugal has reduced its national debt ratio from over 130% of GDP to under 100% within four years and has pursued a liberal economic course to achieve this. In Spain (where GDP is set to rise by 3% this year, more than in the US), both the conservative and the left-wing governments have adopted a business-friendly approach.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

The interest rate on time deposits will fall sharply and soon trend towards 0.25%. With a few exceptions, savings accounts will soon yield even lower interest. |

| Euro / Swiss franc |

|

|

The ECB is likely to cut its key interest rates in half by summer 2025, from the current level of 3.2% to 1.6%, and abandon its restrictive policy. |

| US dollar / Swiss franc |

|

|

We do not expect a weakening of the dollar, which President-elect Donald Trump so desires. |

| Euro / US dollar |

|

|

The exchange rate pair will remain volatile, but we do not believe that the euro is heading directly towards parity with the dollar from its current level of 1.05. |