Liquidity, currency

Declining global inflation

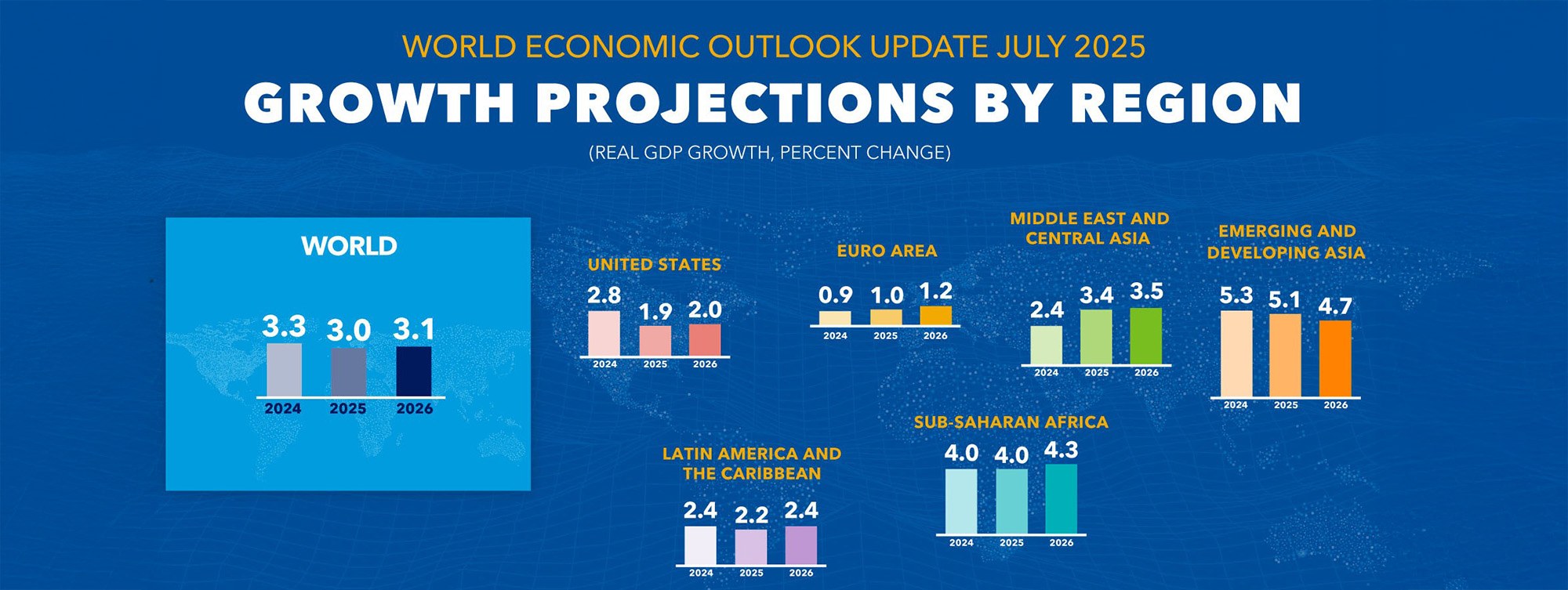

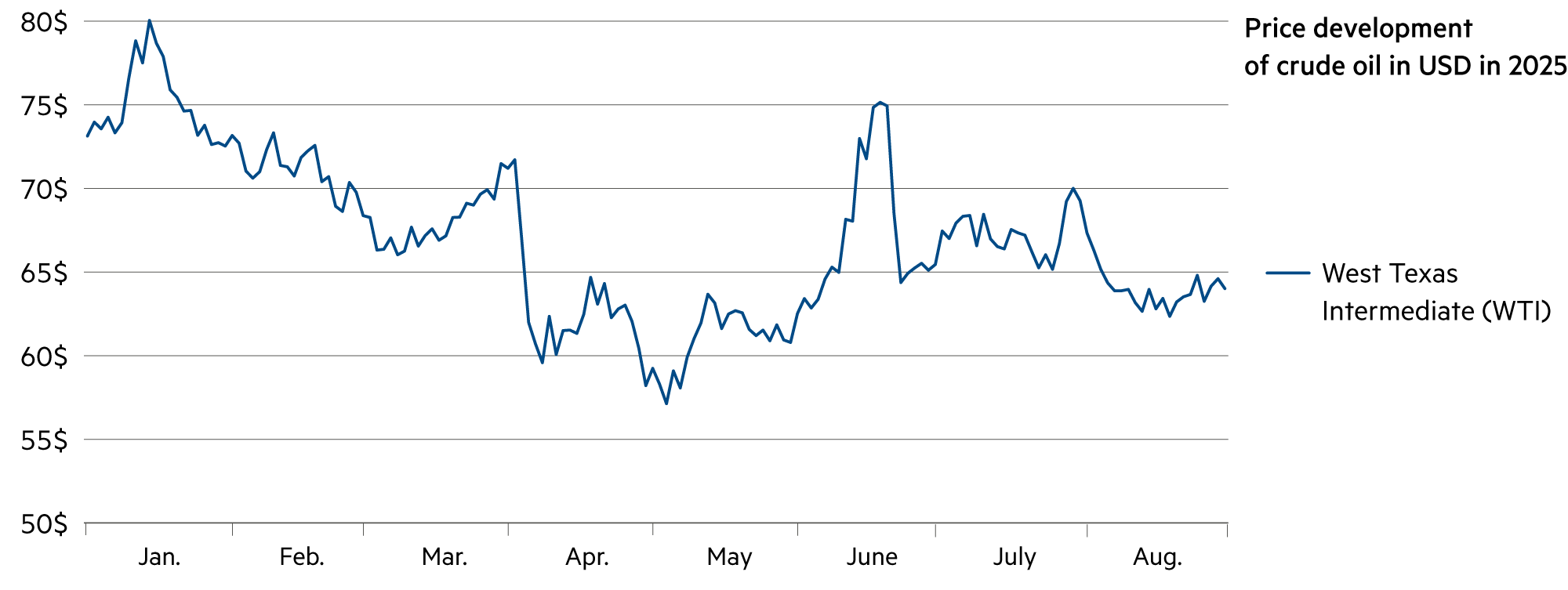

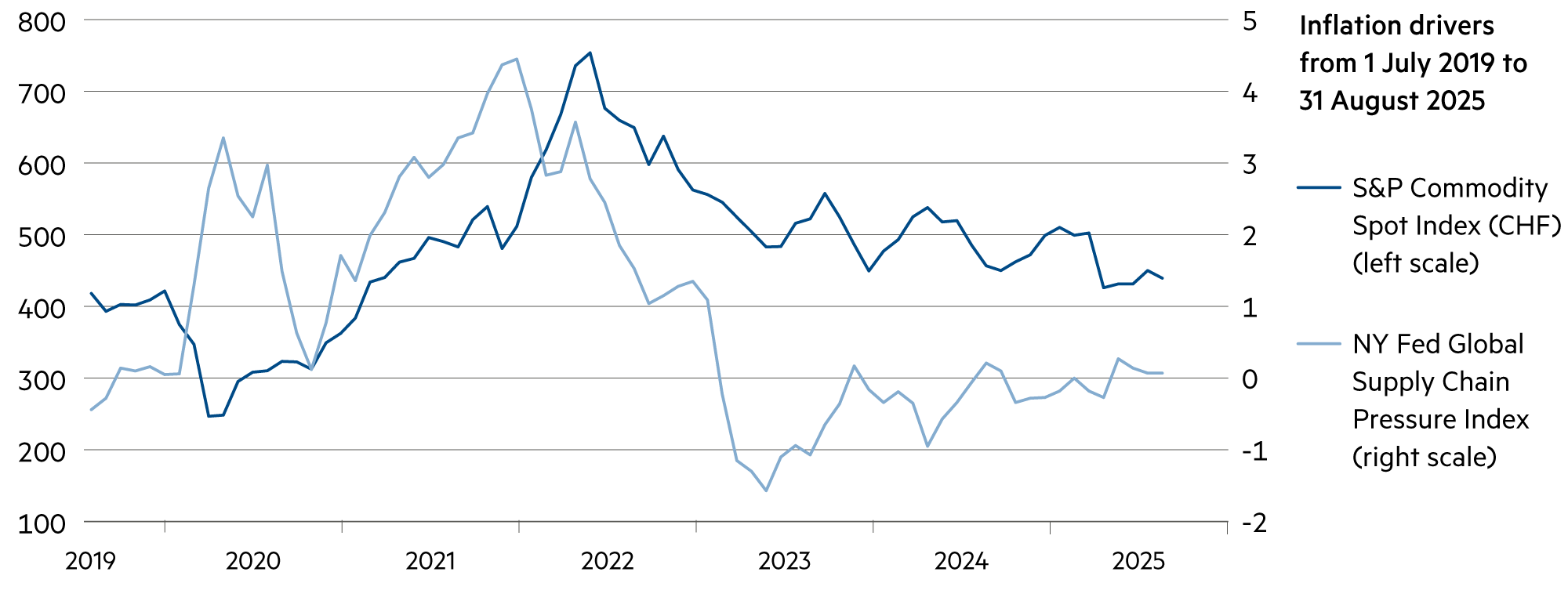

After stagnating at the beginning of the year, the global path to lower inflation now appears to have resumed, supported by falling commodity prices and the weakening dollar. However, two main forces are still influencing investors: concerns about the impact of US tariffs on global demand and the increase in oil production by the OPEC+ oil cartel.

Read more Close

The falling dollar and lower energy and commodity prices have depressed price levels worldwide and contributed to a general trend towards disinflation. Despite ongoing concerns about tariff- and trade-related supply chain disruptions, the New York Fed’s Global Supply Chain Pressure Index indicates no significant pressures. This data, which covers up to May 2025, could still reflect delayed effects, but conditions currently appear stable.

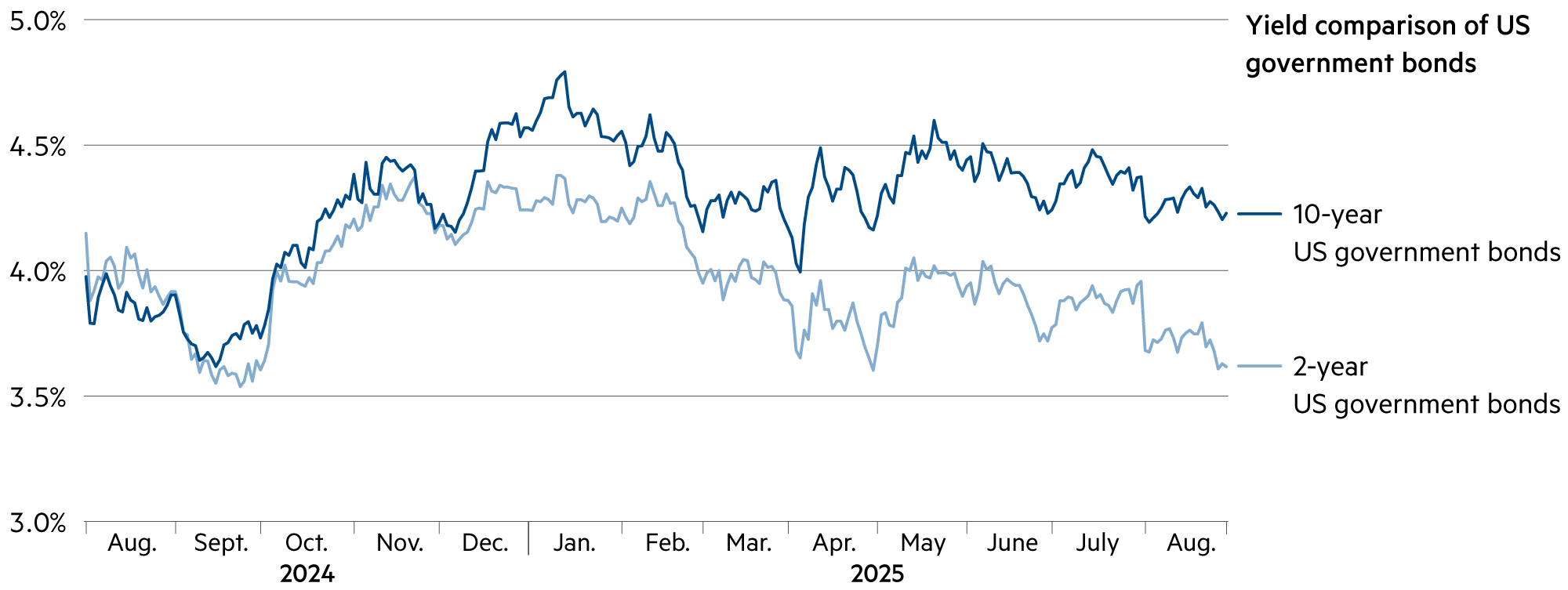

The US dollar remains under pressure to depreciate in the medium to long term. The reasons for this include the persistently high level of government debt in America, the structural current account deficits, and a gradually diminishing interest rate advantage over other currencies. These factors suggest that the purchasing power of the US dollar will decline over time. Nevertheless, technical countermovements and a short-term consolidation are possible in the immediate future.

The euro seems comparatively stable in the current environment. One reason for this is the robust position of the Eurozone, with its solid current account surpluses. In addition, the costs of currency hedging against the dollar have fallen significantly in recent months. They are currently only about half of what they were last year. This makes investments in euros more attractive for international investors and also contributes to the stability of the single currency.

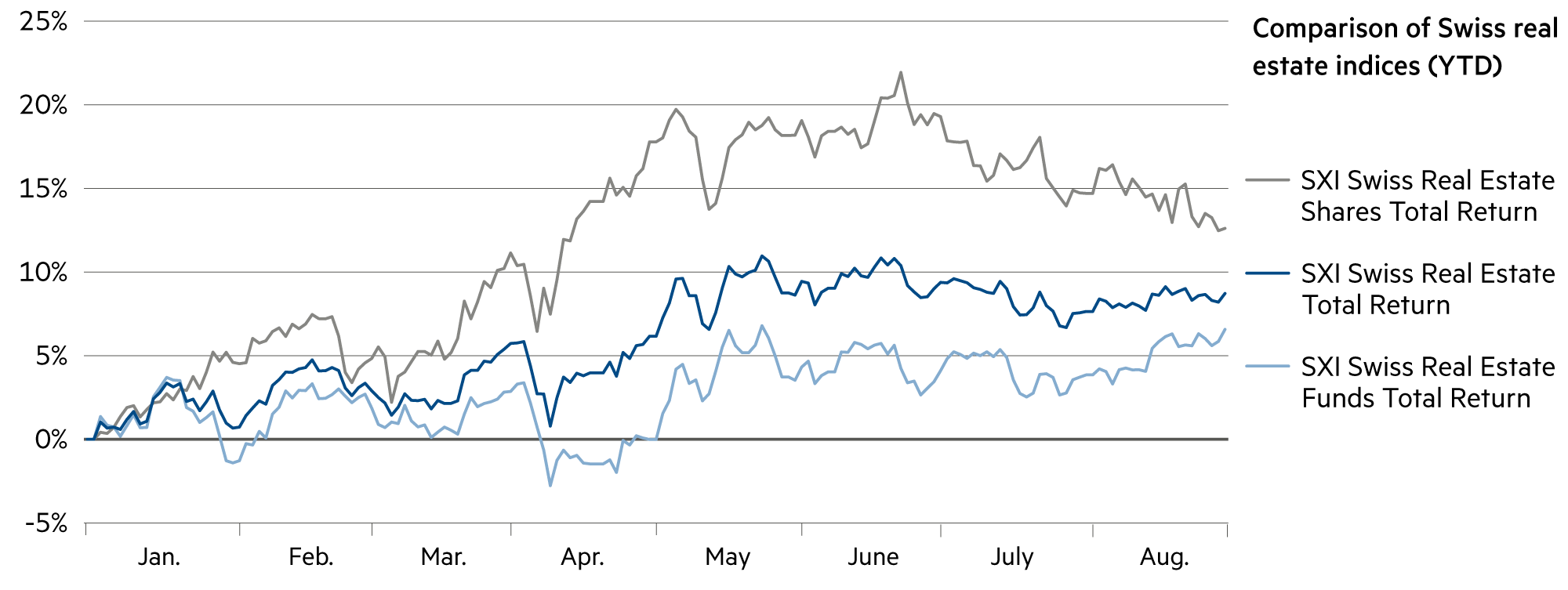

The Swiss franc remained a classic safe haven in August, leading to structural demand. However, this often represents a burden for institutional investors, as liquidity in Swiss francs is sometimes associated with negative interest rates. This is also reflected in the swap curve, which is in negative territory at the short end. This gives rise to opportunity costs for investors with a short-term horizon, while in the long term, the Swiss franc is valued primarily as a stable anchor in the portfolio.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

Positive interest rates on accounts are once again a thing of the past, and institutional investors are already facing negative interest rates. |

| Euro / Swiss franc |

|

|

The Eurozone remains financially stable, and hedging costs against the Swiss franc are now significantly lower. |

| US dollar / Swiss franc |

|

|

After a pause in July, the weakness of the dollar has resumed, and the spot price is back at 0.80 USD/CHF. |

| Euro / US dollar |

|

|

The dollar empire is crumbling. We are currently witnessing a remarkable shift in power in the global foreign exchange markets. |