Liquidity, currency

The new stability of the euro

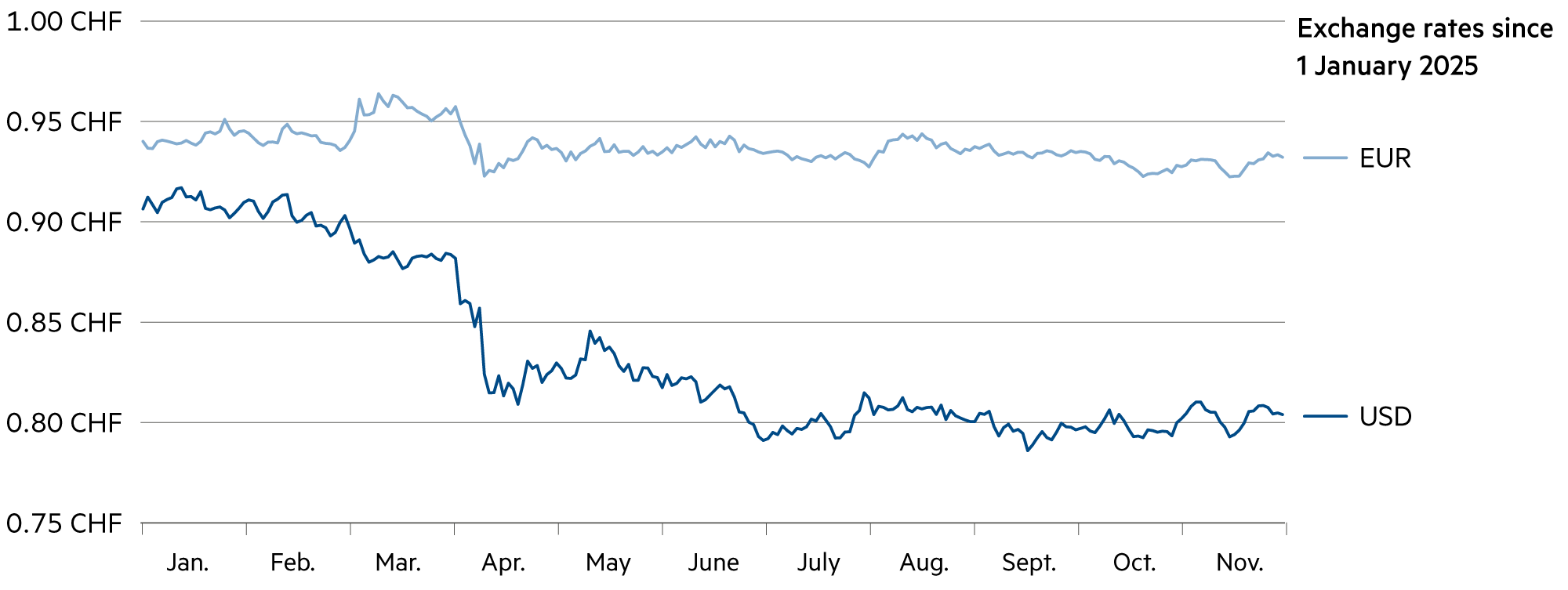

Since the beginning of the year, the euro has fluctuated within a narrow range against the Swiss franc. This new stability is welcome, as it compensates for the instability and increasing volatility of the dollar. The latter is linked to numerous monetary and fiscal policy uncertainties, while the eurozone is proving to be legally secure and stable in terms of value.

Read more Close

Since the beginning of the year, the Swiss franc has appreciated significantly more against the dollar (+12.6%) than against the euro (+0.8%). There is no inflationary pressure in either Switzerland or the eurozone. The factors that have driven disinflation – falling commodity prices and easing pressure on supply chains – have had a downward effect. Given the expected acceleration in economic growth, moderate wage increases and higher commodity prices could cause inflation to pick up again in 2026.

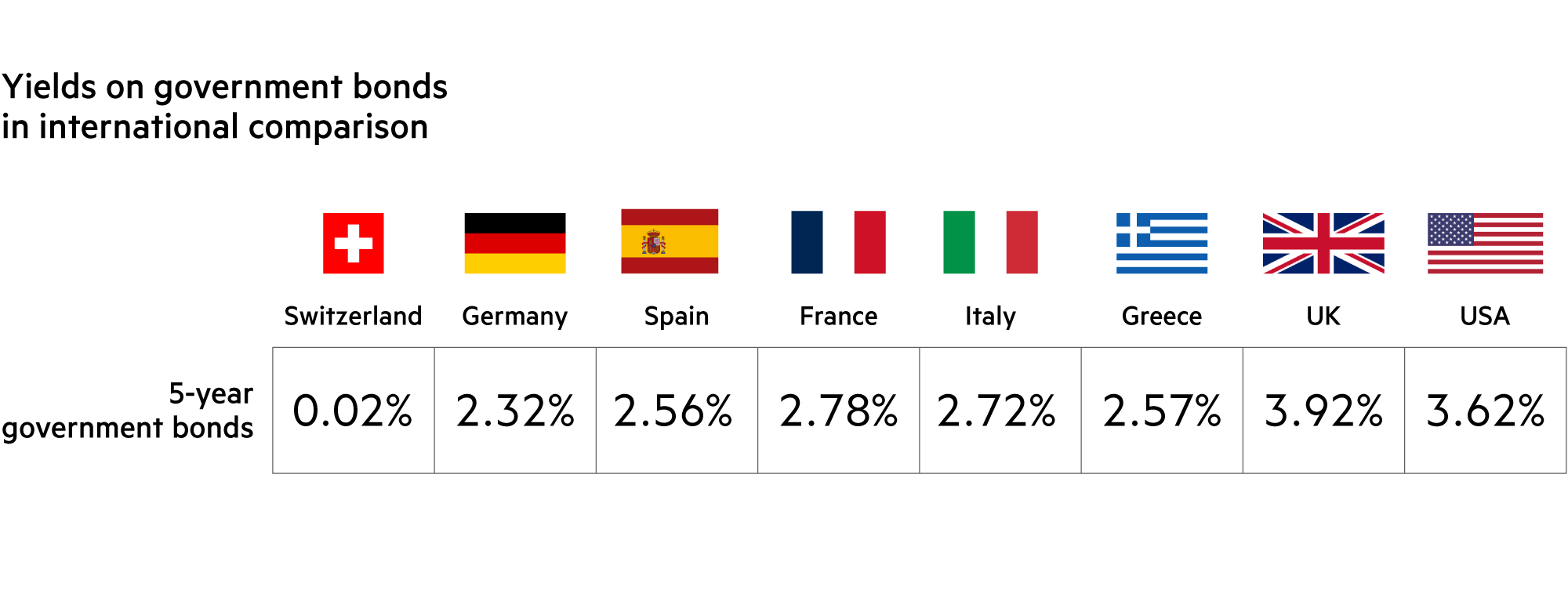

In addition, money supply growth continues to increase, which could intensify inflationary pressure over the next two years. However, there is likely to be further scope for disinflation in Europe in the coming years. The diversion of cheap Chinese exports from the US to European markets is creating a new disinflationary impulse that should allow the European Central Bank (ECB) and the Bank of England (BOE) to make further interest rate cuts by the end of 2026 – more than currently expected by the market consensus.

As an interesting addition to Europe, it is worth mentioning that Italy’s rating has been upgraded by Moody’s for the first time in 23 years. The Italian government budget is continuously generating a so-called primary surplus (before interest on debt).

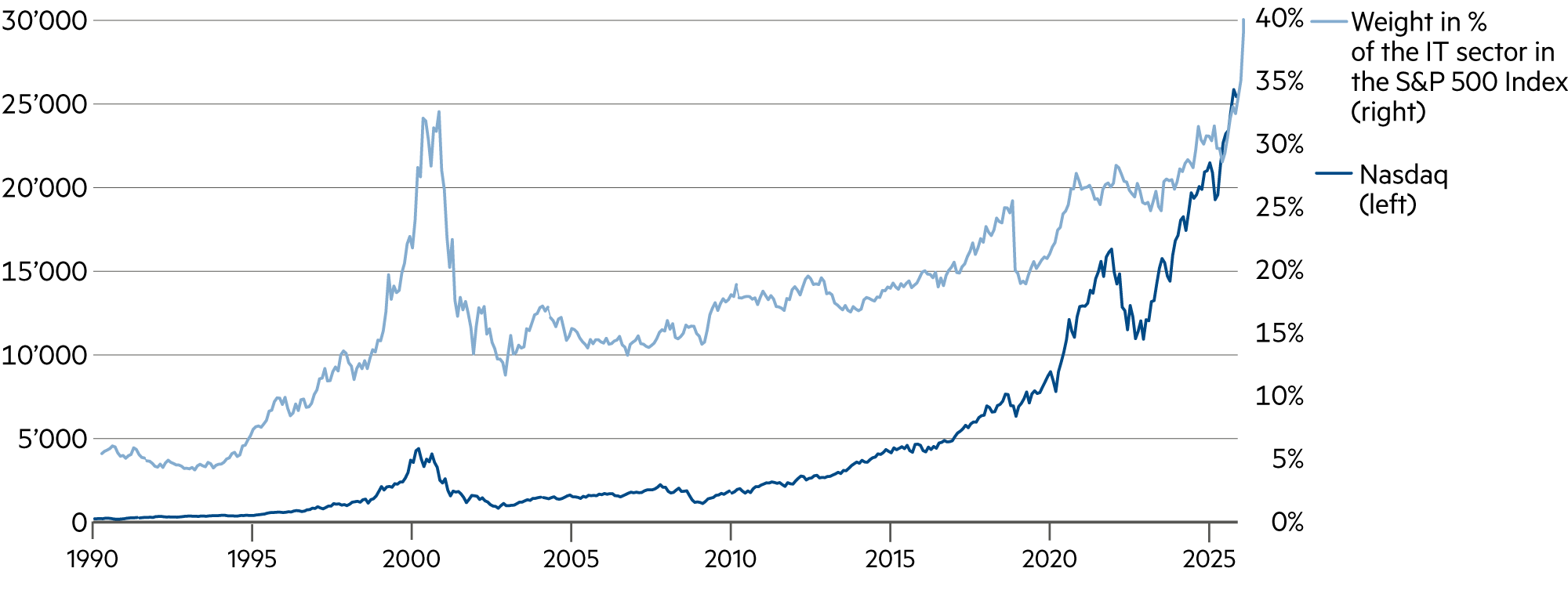

President Donald Trump’s policies dominate the macroeconomic outlook for the US. Of course, the quantitative impact of each individual item on this agenda is debatable. But we know the direction. Higher tariffs, looser fiscal policy (tax cuts, especially for the richest 10% of households which account for 50% of all consumption) and stricter immigration policy are likely to increase inflationary pressure in the economy. At the same time, emigration from this traditional immigration country is reducing output potential.

At best, we can hope that the Fed, which is increasingly influenced by politics, is right in its forecast of a one-off rise in price levels due to tariffs (or “temporary” inflation). But the experience of 2021/22 shows how wrong the Fed can be in its assessments. It massively underestimated the development of the inflation rate. We tend to believe that inflation in the US is likely to remain permanently above target in the coming years.

If, in its response to its two objectives (price stability and full employment), the Fed were to place more emphasis on the labor market and less on inflation data in the future, this could lead to greater key interest rate cuts than the market currently expects. Against the backdrop of financial conditions that are already loose by historical standards, this would certainly weaken the stability of the dollar.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

Interest rates on larger amounts have slipped back into negative territory at major banks. Even for individual customers, rates above 0.0% are likely to become the exception. |

| Euro / Swiss franc |

|

|

We expect the exchange rate against the euro to remain stable over the next 12 months. Hedging costs are likely to remain at 2.2% p.a. |

| US dollar / Swiss franc |

|

|

Goldman Sachs expects the exchange rate to fall from 0.80 to 0.74 in 12 months. All public forecasts predict a weakening. |

| Euro / US dollar |

|

|

The euro is likely to move northwards towards 1.20 rather than southwards from its current level of 1.16 against the dollar in the coming quarters. |