Liquidity, currency

The declining purchasing power of the dollar

Since the beginning of the year, the euro has fluctuated within a narrow range against the Swiss franc. This new stability is welcome, as it compensates for the instability and increasing volatility of the dollar. The latter is linked to numerous monetary and fiscal policy uncertainties, while the eurozone is proving to be legally secure and stable in terms of value.

Read more Close

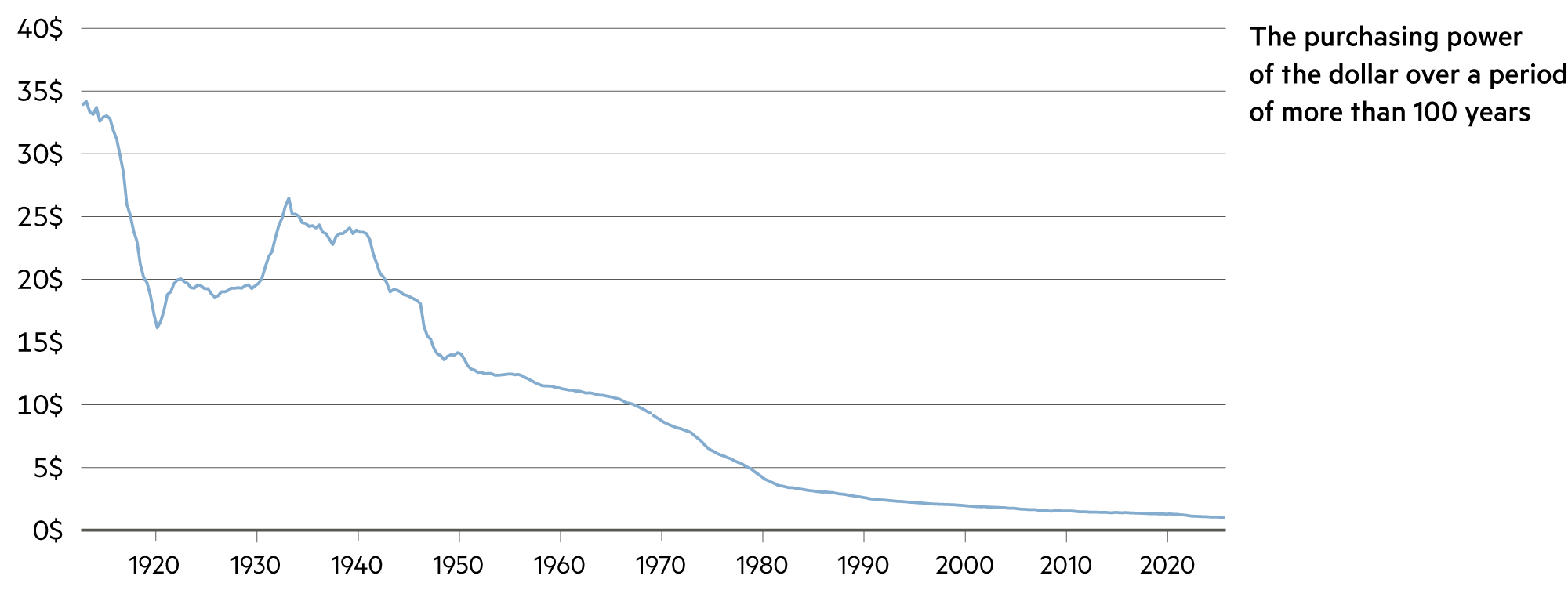

In 1910, one dollar could still buy 30 Hershey chocolate bars (his Swiss ancestors were called Hirschi, but the name was changed in the US). Today, a milk chocolate bar at Walmart costs $1.82 – 55 times more. Conversely, it can be calculated that more than 98% of purchasing power has been destroyed in just over a century. Today, $1.00 corresponds to less than $0.02 in purchasing power.

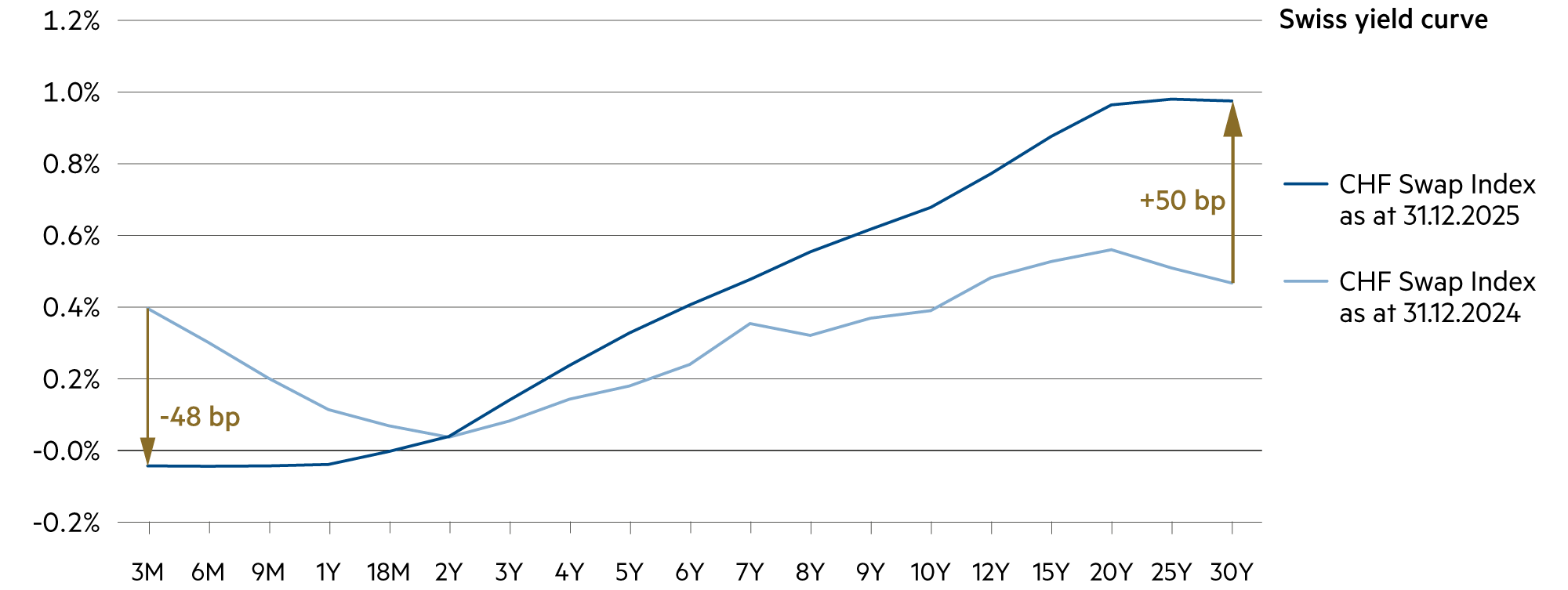

Since the introduction of flexible exchange rates in 1971, the dollar has also suffered severe losses in its external value: -81.4%. Initially, one had to pay 4.30 francs for one dollar, today it is only 79 centimes. There is another component to this loss of purchasing power. We must continue to expect an annual loss in value of 3%. However, the trend is unlikely to be linear. This could lead to the idea of hedging the currency. This currently costs 3.8% per annum. In 2024, it would not have been worthwhile, but in 2025 it would have been. Whether it will be worthwhile in 2026 is difficult to predict.

The lower currency hedging costs against the euro (approx. 2.1%) reflect more sustainable fiscal and monetary policy as well as lower inflation and interest rate differentials. In the case of the dollar, the political crisis of confidence in 2026 could prevent it from bottoming out. In the past, the dollar has always weakened when the Fed has cut interest rates and the US has not been in recession. In addition, markets could further strengthen their expectations of multiple interest rate cuts by the Fed in 2026 with the appointment of a new Fed chair who is loyal to Trump. This is compounded by questions about the Fed chair’s ties to the White House. This could lead to further currency depreciation.

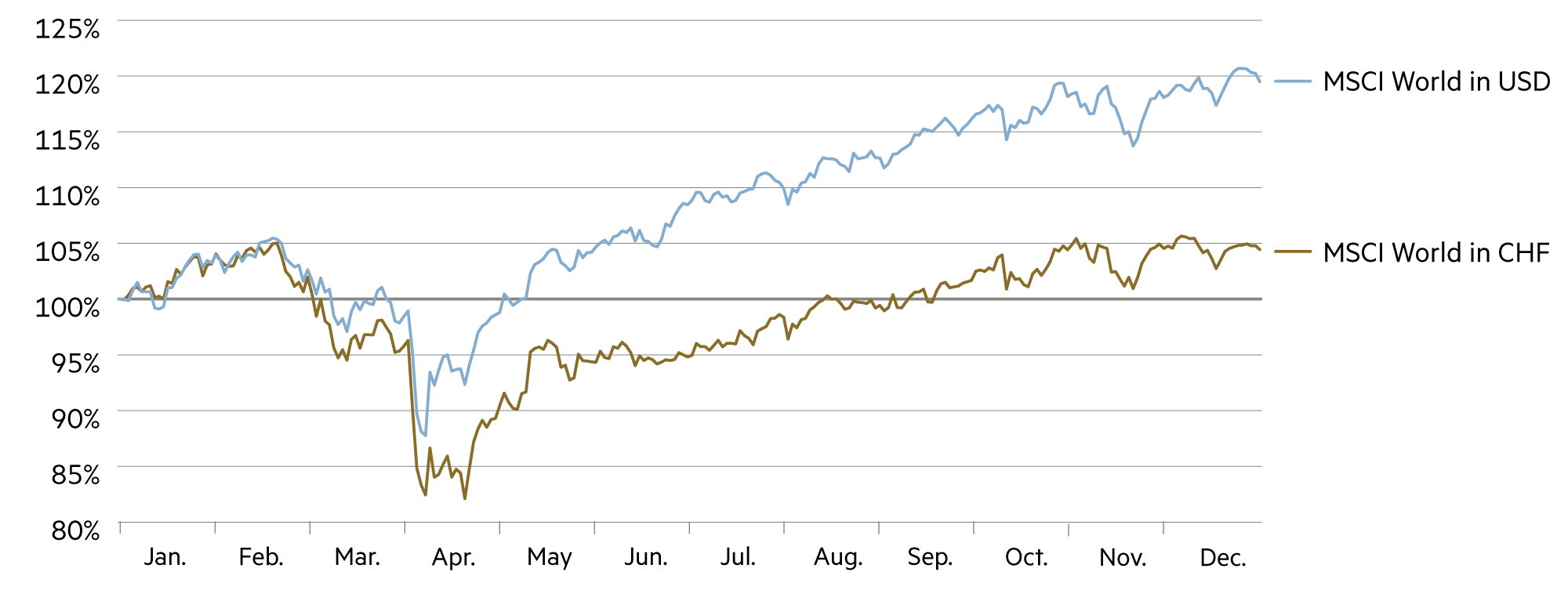

In this context, it is important to consider whether you are looking at things from a dollar or a franc perspective. Last year, the US stock markets rose impressively, but the returns converted into francs looked modest. The Dow Jones (with stocks such as Nvidia, Apple, Amazon, Microsoft, Salesforce, and Cisco) rose +13.0% in dollars. In Swiss francs, this resulted in a return of -1.3% (!). The Nasdaq technology index (+20.2% in USD) performed less well in Swiss francs (+5.0%) than the Swiss SMI (+14.1%). And the broad S&P 500 index from the US (+16.1% in USD) translates into a meager +1.0% (in CHF).

The Chinese currency also performed poorly, meaning that the Hong Kong-traded Hang Seng Index (+13.8% in CHF) and the Shanghai/Shenzhen Index CSI 300 (+12.2%) did not generate exceptional returns either – and this in a year that dealt US tech giants a significant blow with DeepSeek. They had to learn quickly that technological competition is not limited to the players in Silicon Valley.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

Inflation is likely to remain at the lower end of the SNB's target range. Further interest rate cuts are not expected. Bank accounts no longer earn interest. |

| Euro / Swiss franc |

|

|

In 2025, the EUR/CHF moved mostly sideways. The ECB and SNB are leaving their key interest rates unchanged, so the interest rate differential remains stable. |

| US dollar / Swiss franc |

|

|

Due to the expected interest rate cuts, the USD is likely to weaken further in 2026 if inflation remains high. |

| Euro / US dollar |

|

|

The EUR/USD appreciated strongly in 2025. In 2026, we see only limited upside potential for the euro. |