Liquidity, currency

Inflation still on the decline

There is no doubt that inflation will continue to decline in autumn 2023. But the steep part of the decline is already behind us. A year ago, inflation in the USA was 9%, now it is 3%. However, if housing costs were calculated and weighted the same way they are in Europe, US inflation would already be below the target of 2%. In Switzerland, only the Swiss National Bank (SNB) can fuel inflation over the next 12 months.

Read more Close

The SNB greatly underestimated the upswing in inflation in 2022. In January 2023, inflation was +3.3% compared to the same month of the previous year. But the impressive decline was likewise unexpected. The inflation rate has more than halved within a very short time. In August 2023, inflation in Switzerland was +1.6% compared to the same month of the previous year. Core inflation even fell to +1.5%. This is evident from the latest figures from the Federal Statistical Office (FSO).

We have always been somewhat more optimistic than the SNB when it comes to inflation trends. This is mainly due to the fact that we have assessed the development of rental prices differently. The FSO incorporates the results of its rent index into the inflation rate on a quarterly basis in the months of February, May, August, and November. As a result, the effects of the SNB’s key interest rate increases, which have a large influence on the reference rate for rents, are factored into the index at a delay. We expect the next boost from November 2023 onwards, which could be even larger if the SNB tightens the reins again when it reviews its monetary policy on 21 September.

Due to the increased reference mortgage rate for leases in June 2023, moderate rent increases are expected. The extent to which and how quickly the adjustments to existing leases will affect the results of the rental price index can be assessed in the quarters from November 2023 onwards. These effects are not yet visible in August 2023. In addition to the adjustments due to the increased reference interest rate (1.5%), which could even be accelerated by the SNB decision in September, a large number of other factors also influence the rental price development captured in the rental price index (such as new constructions, renovations, or tenant changeover).

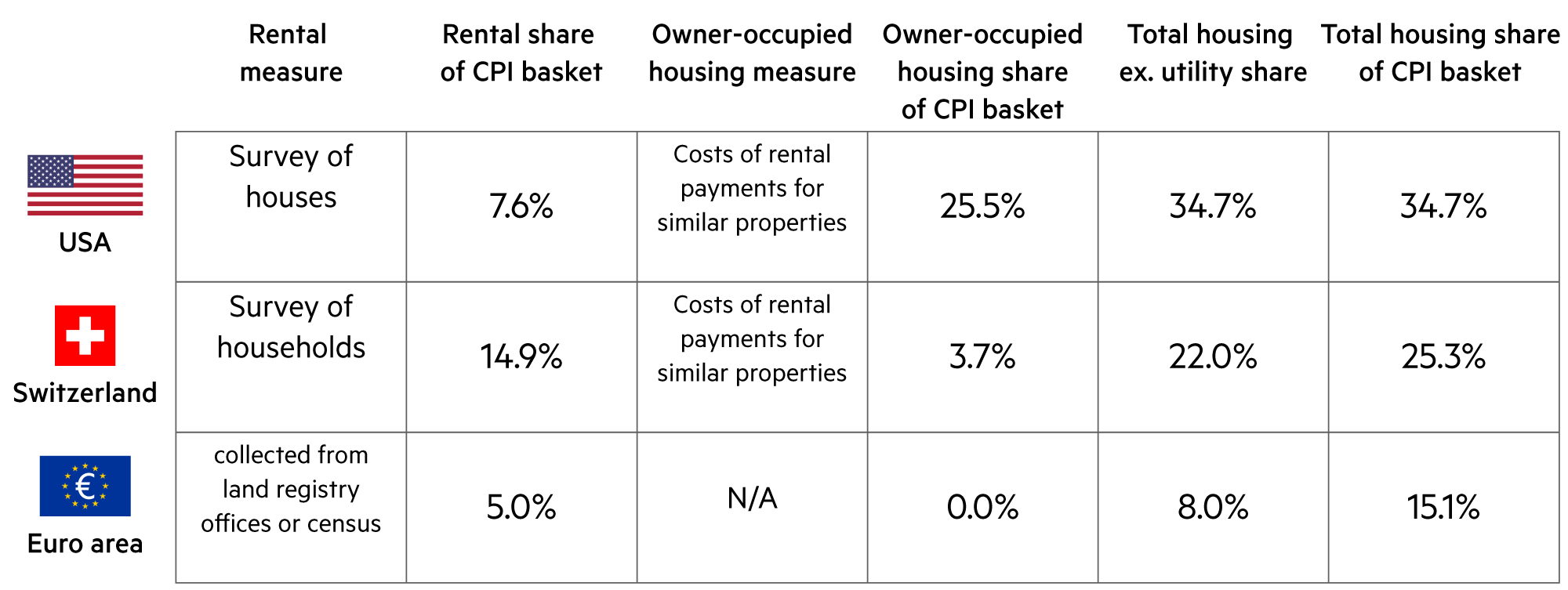

The interesting thing is that although we compare inflation values across borders, we overlook the fact that the corresponding variables are measured very differently. When looking at US inflation as a trendsetter, it is important to know that “housing” is factored into the inflation calculation with a weighting of around 35% and that this factor is technically linked to the Fed’s key interest rate. If the Fed stops raising key interest rates for a year, inflation will stay out of this range. If housing costs were calculated and weighted the same way today as they are in the eurozone, inflation would already be below the Fed’s target – which would be accompanied by faster key interest rate cuts, more stable real estate markets, more robust regional banks, more stable economic prospects, and rising equity prices.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

A lot of consideration should be given to deciding whether to invest in a savings account, medium-term bonds that do not conserve purchasing power, or sound securities investments. |

| Euro / Swiss franc |

|

|

The euro remained stable at 0.96 in August. Technically, however, the outlook for the euro has deteriorated. |

| US dollar / Swiss franc |

|

|

The devaluation pressure continues unabated due to the huge twin deficits (government budget balance, trade balance) and higher inflation. |

| Euro / US dollar |

|

|

In August (-1.4%), the euro lost almost its entire lead from 2023 and ended the month only 0.9% above the beginning of the year. |