Liquidity, currency

Falling key interest rates in Europe

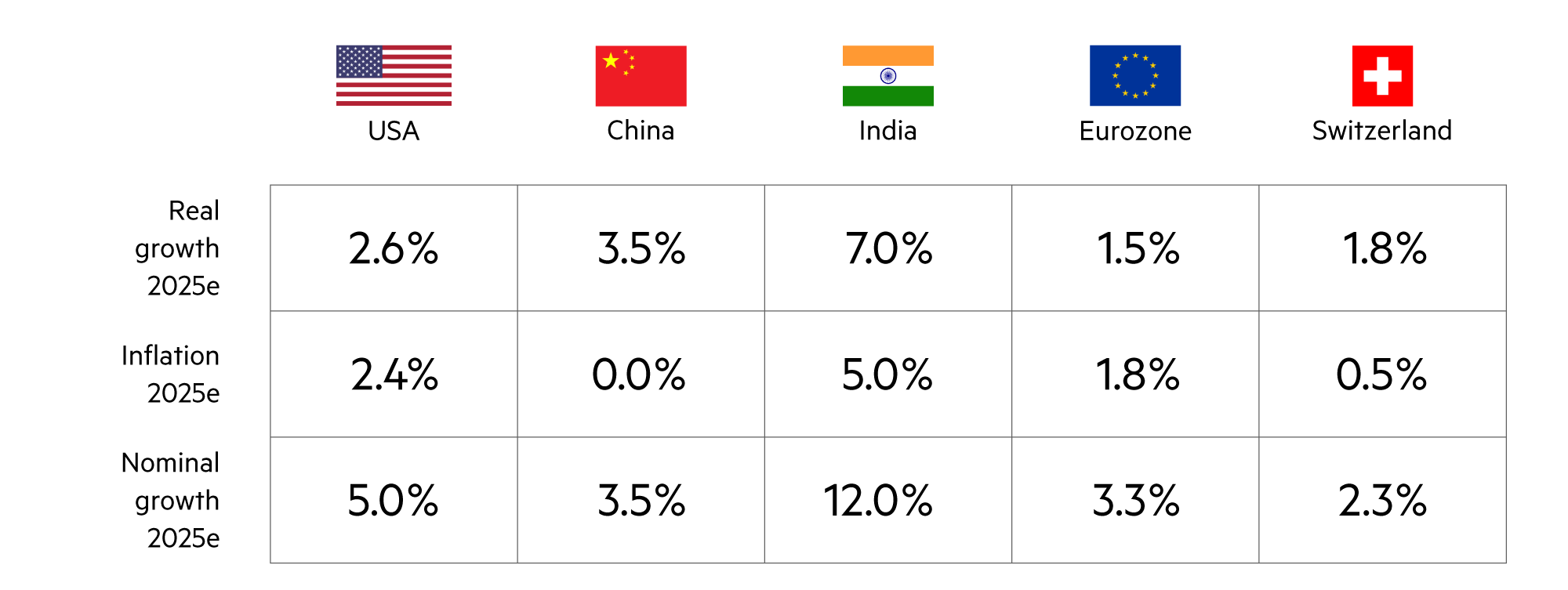

A dynamization of the global economic growth is not in sight due to the ongoing geo- and economic policy challenges. However, the economy should benefit from high public and private investments, deregulation and tax cuts. In Europe, we continue to expect robust labor markets, rising real wages and intact consumer values, which are supported by falling key interest rates.

Read more Close

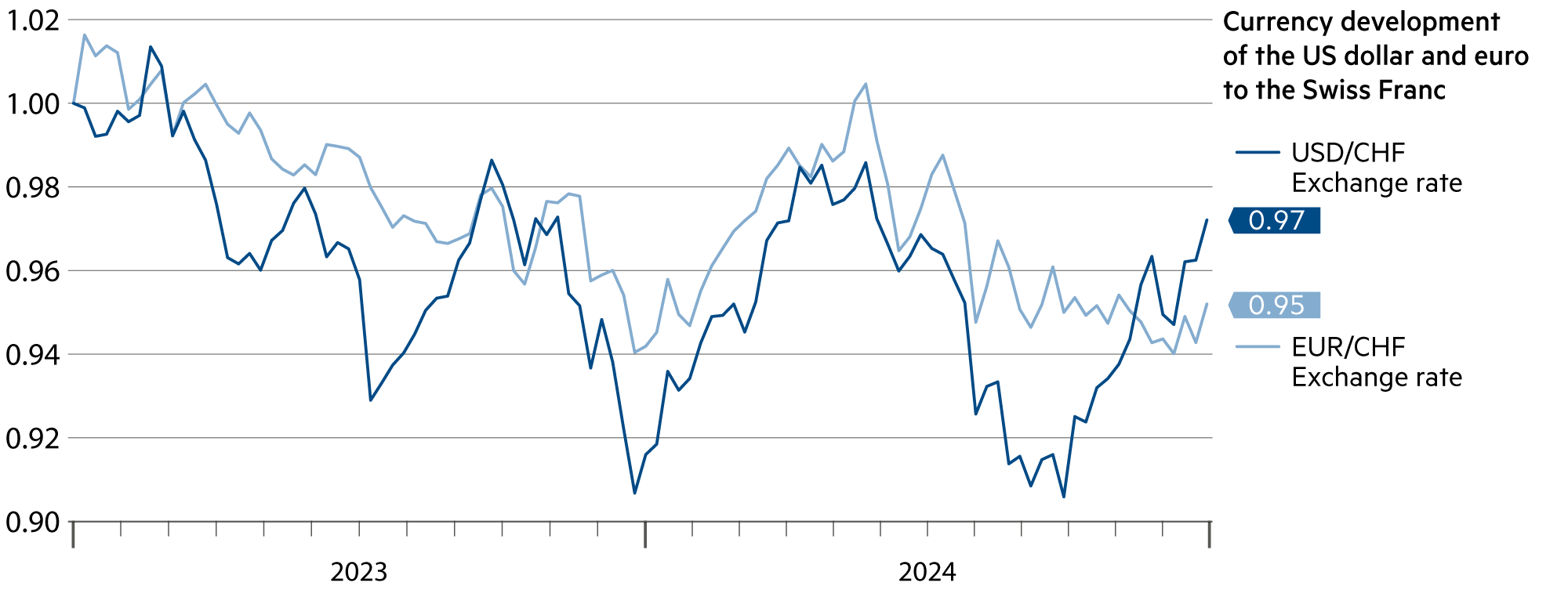

The European Central Bank (ECB) is likely to cut its key interest rate in half to 3.0% this year, thereby also reducing the external value of the euro and increasing competitiveness. Over the last two years, the euro has lost 4.9% against the franc.

The exchange rate development of the dollar was associated with much greater fluctuations. In 2023, the dollar lost a little over 9% against the Swiss franc in waves. In the first five months of 2024, it recovered this again, but lost everything again by the end of September. In the final quarter, the dollar gained 8% and is now only 2% lower than two years ago. But the depreciation pressure remains.

The corresponding exchange rate development is far from stable. In recent years, the rate of inflation in the US has always been higher than in Switzerland. Depending on the method of measurement and the time period, the average of the inflation differential is 2.3 percentage points. From the past ten years, it can therefore be roughly deduced that the annual depreciation potential is around 2.3%. There may be deviations in the short term, but not in the long term.

As in the eurozone, key rates in Switzerland are also expected to fall further. By contrast, growth in the US is likely to be higher, which should also be accompanied by higher inflation rates. Expectations of key rate cuts in the US are therefore significantly lower, which also suggests that the dollar is likely to remain relatively strong for a few quarters.

In recent years, the US productivity and growth gap with Europe has widened across countries and sectors. In Switzerland, with its low inflation rate, the Swiss National Bank could again lower its key interest rate when it assesses the monetary policy situation in March 2025. This would certainly somewhat reduce the structural upward pressure on the Swiss franc.

However, we currently rule out larger cuts and a return to a renewed negative interest rate period. Inflation rates in Switzerland will remain low for the time being. The average 10% reduction in electricity prices is likely to lower the inflation rate by 0.2 percentage points. In addition, rents will fall due to a reduction in the reference interest rate for rents.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

Six-month swap rates (0.3%) are even higher than those for 12 months (0.1%), but the trend towards zero interest rates on savings accounts is unmistakable. |

| Euro / Swiss franc |

|

|

The ECB is likely to reduce its key interest rate much more sharply than the SNB. Nevertheless, we expect the exchange rate to remain stable in 2025. |

| US dollar / Swiss franc |

|

|

In the second half of the year, the dollar could depreciate by 4% to 5%. In the short term, nothing will shake its stability at 0.91. |

| Euro / US dollar |

|

|

Despite increasing interest rate differentials, we expect the euro to appreciate gradually against the dollar. |