Liquidity, currency

Cash is king?

The influence of returns on asset growth is systematically underestimated in Switzerland. This is one of the reasons why little money is invested in equities in Switzerland. Banking statistics show that Swiss households ultimately do not invest their money. Significantly more money is hoarded in virtually interest-free bank accounts than invested in securities solutions. Yet assets double every 10 years if you earn 7% per year with stocks over the long term.

Read more Close

When it comes to liquid assets that could be invested, we are not talking about a “nest egg” or emergency fund comprising perhaps three to six months’ salary that is set aside for unforeseen circumstances. These are liquid assets that should remain untouched. Planned consumer spending, such as an upcoming safari or the purchase of a new car, falls into a similar category.

We are primarily concerned with liquid assets that contribute to strategic wealth accumulation or preservation. This is capital that investors can use to invest countercyclically when attractive opportunities arise.

April was such a month, and in addition to our weekly reports, we contacted our clients twice to consider additional investments at low prices. It is not too late to buy quality stocks at significant discounts.

It is also interesting to note that even where long-term investments are the norm (tax-privileged pension savings under the third pillar), a large proportion of Swiss households’ assets are still not invested in securities.

According to the Swiss National Bank’s (SNB) asset statistics, assets in 3a pension funds totaled CHF 143 billion at the end of 2023. Of this, 40.4% was not invested.

Liquidity yields little or no return, while long-term returns on the stock market are significantly higher. Investing is always a personal matter. Depending on their risk capacity and risk appetite, investors opt for a low, medium, or high equity allocation. Only one thing is certain: not investing in real assets in the long term is associated with high opportunity costs.

There are many reasons to invest, and at least part of your assets should be invested in equities. Here are the three most important reasons:

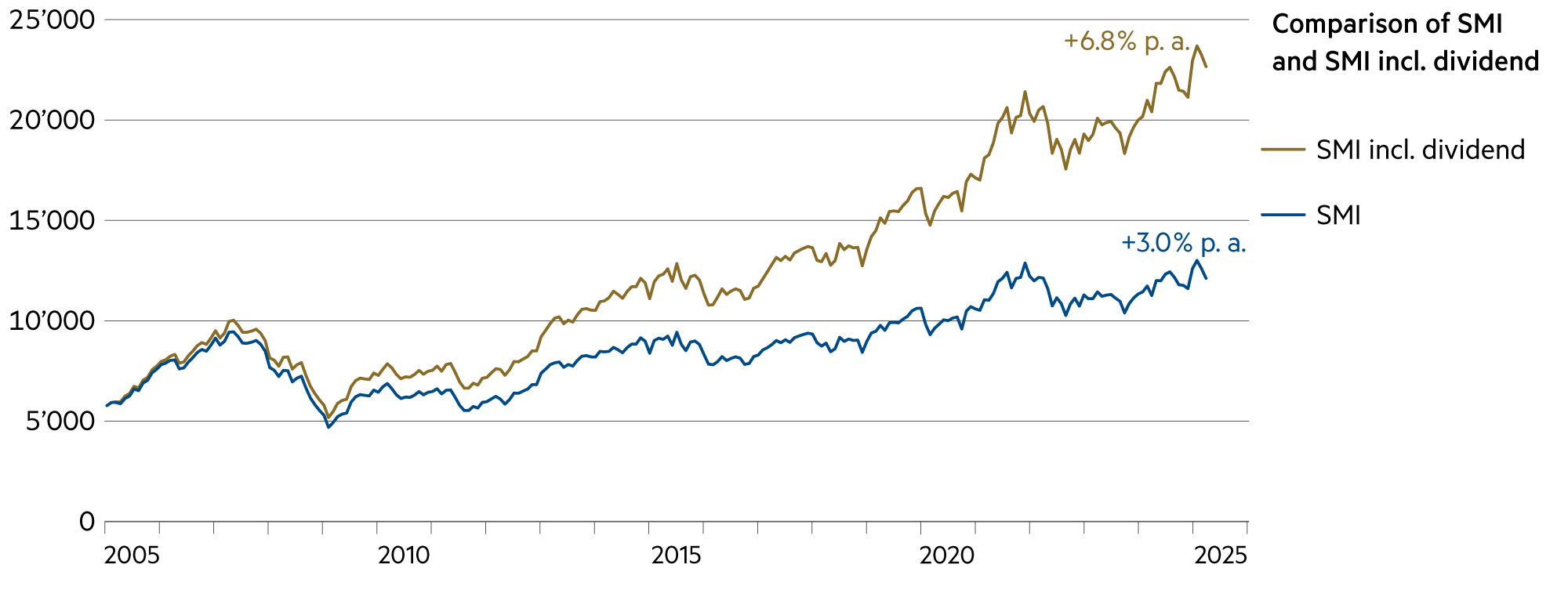

1) A high equity allocation is worthwhile because of the compound interest effect on dividends and the historically positive performance of stock market returns. The SMI has gained 3.0% annually over the past 20 years. If you add dividend income and reinvest it, the total return is 6.8% per year.

2) Because you benefit from the highest-yielding investment with stocks: you benefit in the short term from dividends and in the longer term from expected price gains resulting from retained earnings of listed companies.

3) Because we pursue an investment strategy that primarily prioritizes Swiss stocks, the (exchange rate) risks are massively reduced: By focusing on convincing business models with high, positive cash flows and a long-term growth path, we significantly reduce the risks of volatility.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

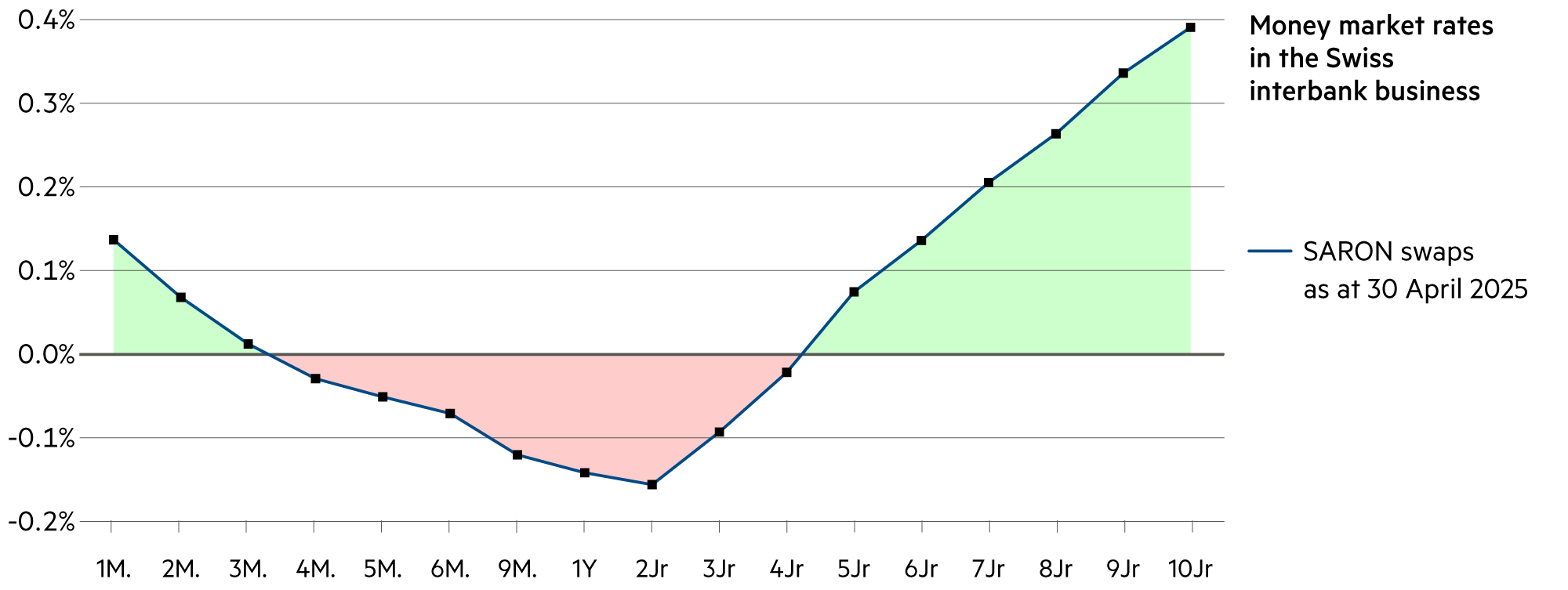

The Swiss National Bank (SNB) is further reducing interest payments to domestic commercial banks. From June 1, less interest will be paid on sight deposits. |

| Euro / Swiss franc |

|

|

In April, the ECB decided on its seventh interest rate cut since mid-2024 and lowered the key interest rate in the eurozone to 2.25%. However, there is still room for maneuver. |

| US dollar / Swiss franc |

|

|

Fed fund rates are likely to remain high and restrictive until June 18, forcing the economy to cool down against the will of the US president. |

| Euro / US dollar |

|

|

The current exchange rate of 1.14 should develop positively within a range of 1.15 to 1.18 if the European economy recovers as expected. |