Liquidity, currency

Europe on the upswing

Inflation is falling significantly in Europe, boosting confidence. Favorable financing conditions are making investments more attractive and increasing the willingness to invest capital for the future. Demand for credit is rising in Europe, and European equities have continued to outperform US equities by around 20% since the beginning of the year. Taking into account the weak dollar, the performance differences are even greater.

Read more Close

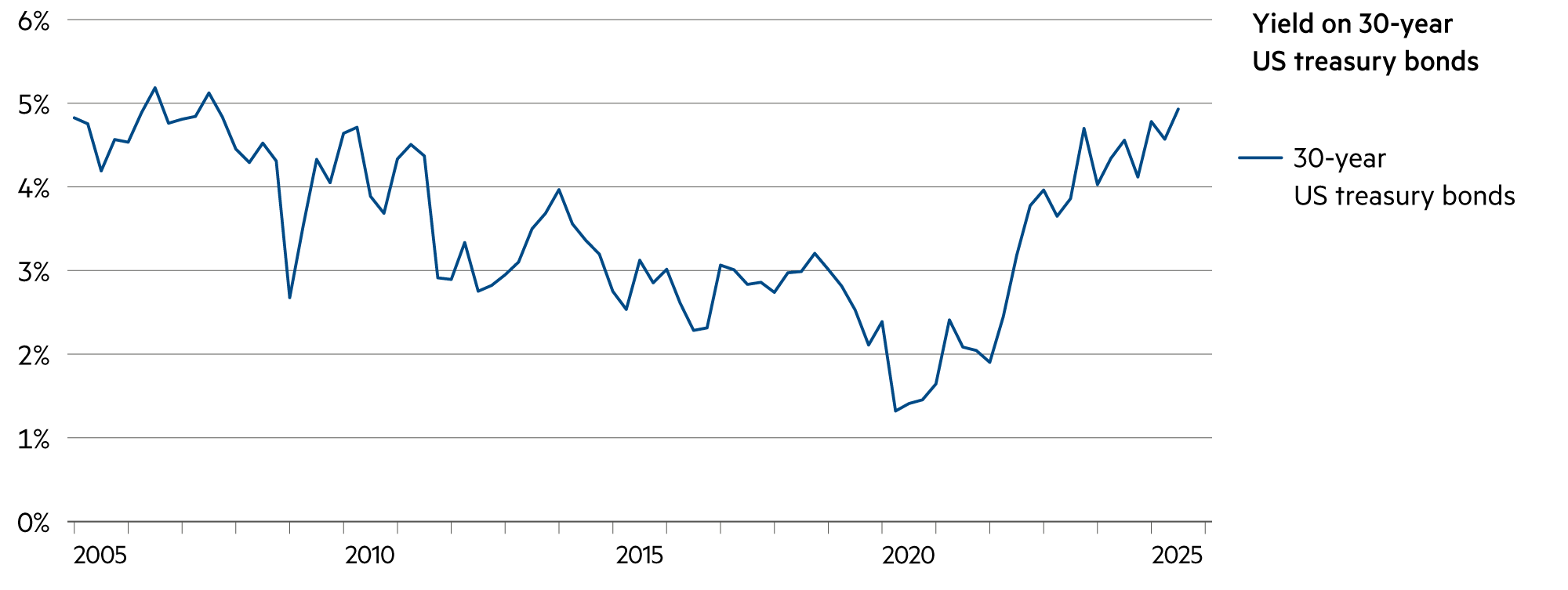

The rapid recovery of share prices from their lows at the beginning of April is surprising, particularly in the US, given that the growth outlook for the US economy has deteriorated recently. Responding to this will be challenging for the highly indebted US in terms of monetary and fiscal policy. The bond market clearly signaled its skepticism about further tax cuts. In addition, uncertainty surrounding radical US tariffs and unpredictable U-turns is weighing heavily.

There is a lack of predictability not only in the short term but also in the long term, with Donald Trump likely to usher in a period of greater economic nationalism and protectionism after decades of free trade. However, as this is only a theory, investment projects in the US are being postponed indefinitely.

US President Donald Trump, who is accustomed to victory, has suffered massive setbacks in recent weeks, whether in negotiations with Russia (Ukraine), Iran (nuclear program), China (tariffs, trade), Canada (trade), or on the capital market (US Treasuries, rating agency Moody’s).

Nervousness is growing in his camp because he faces heavy losses in next year’s midterm elections if he continues to pursue his current policies and ultimately provokes higher inflation and an economic downturn as a result of tariffs. It would be the first recession in US history that could be attributed to the actions of a single person.

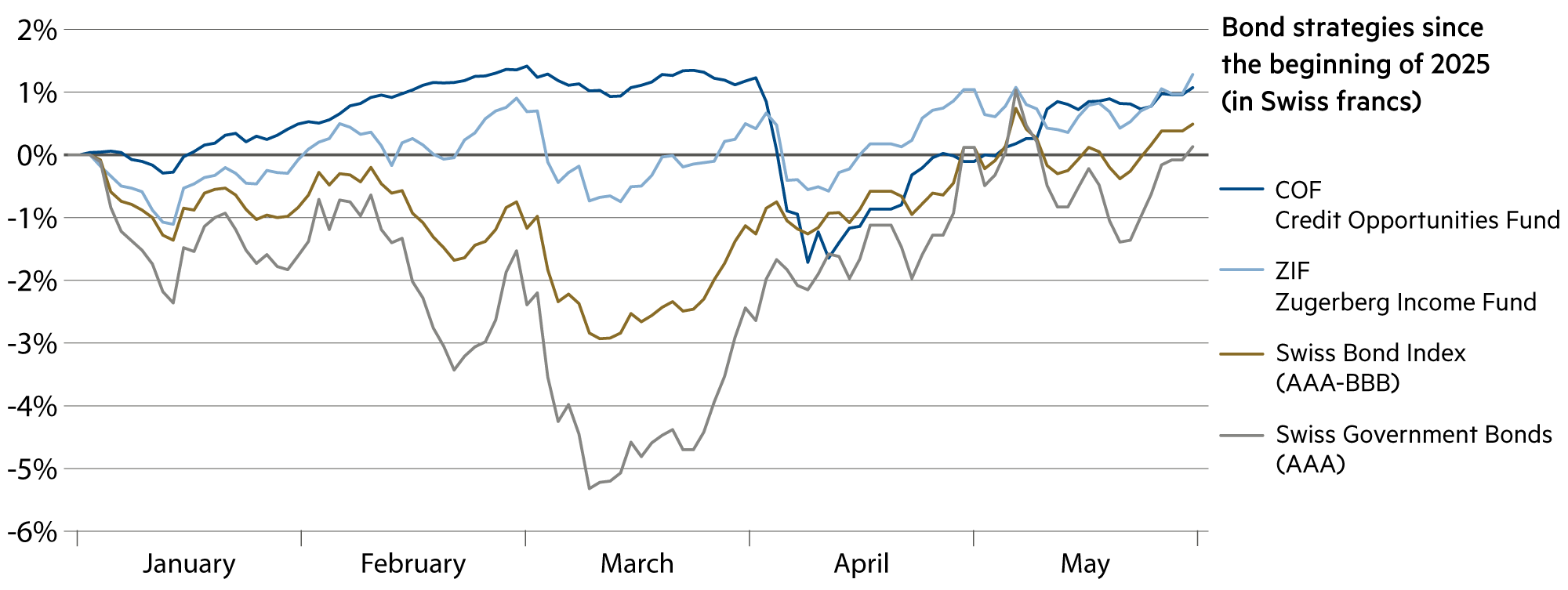

We have long been prepared for more protectionism and slower economic growth in our portfolio strategies with a strong focus on defensive stocks. The vast majority of US equities are facing lower margins, declining profits and falling prices. We therefore remain underweight in this sector and are investing exclusively in global market leaders with positive earnings growth rates, such as Microsoft, Mastercard and Nvidia, whose core products continue to be manufactured primarily in Taiwan.

In Europe, we are seeing talent, capital, and innovation flowing in from North America. Basic research is world-class in many areas, and now massive investments in the real economy are following: EUR 1 trillion in Germany’s future fund for defense, security, and infrastructure.

The European space program is being accelerated, and the EU is investing EUR 200 billion in AI development alone. Private sector investment is likely to more than double this amount. All of this is leading to MEGA: Make Europe Great Again. Investors believe in it, which is why European markets are performing better than their American counterparts.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

At the short end, banks are lending money to each other at -0.07% (3 months), -0.27% (12 months) and -0.09% (4 years): we are back in a period of negative interest rates. |

| Euro / Swiss franc |

|

|

Financial stability in the eurozone strengthened the euro and had a net positive impact on GDP due to reduced volatility, which in turn strengthened the euro. |

| US dollar / Swiss franc |

|

|

The sharp appreciation of the Swiss franc is contributing to the decline in inflation and the negative trend in import prices (e.g., raw materials). |

| Euro / US dollar |

|

|

The euro has appreciated more quickly than expected to 1.14. In the eurozone, the ECB's neutral monetary policy caused the inflation to fall below the target of 2%. |