Liquidity, currency

All-time highs in dollars

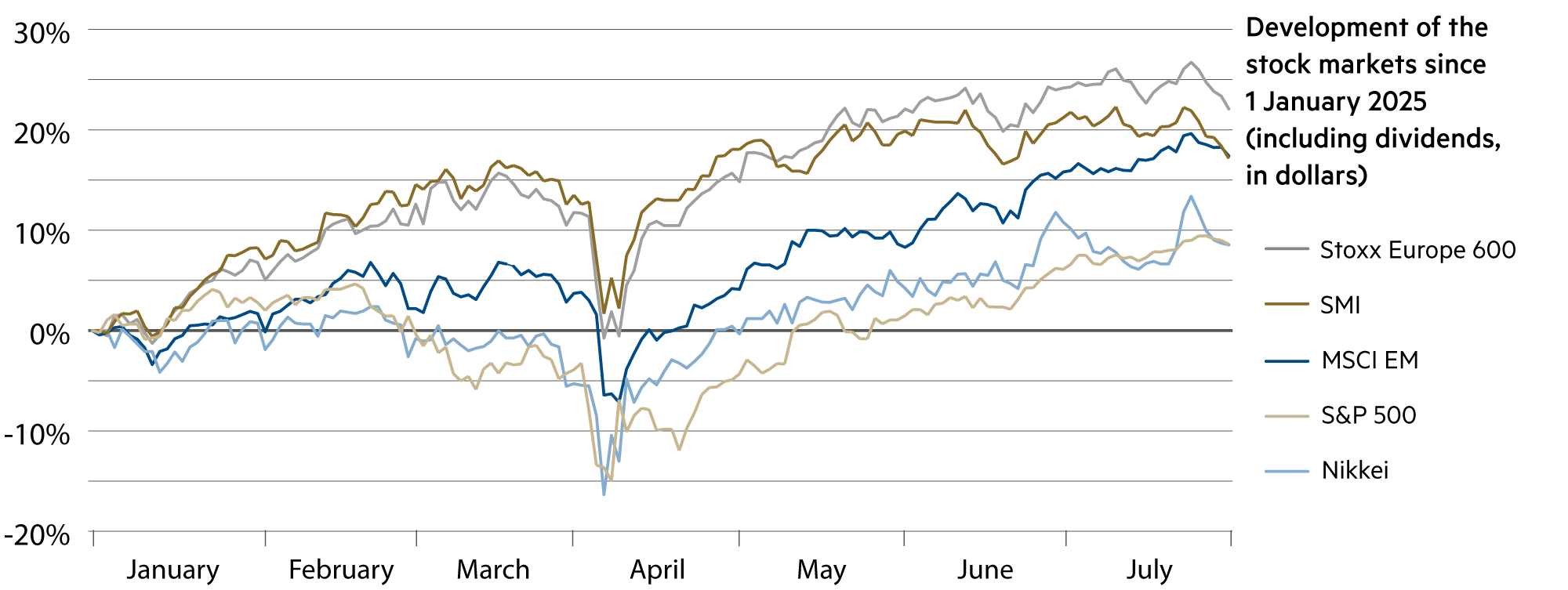

The stock market performance in the first seven months was marked by a slump in April caused by US President Donald Trump’s tariff disputes. This was followed by a strong recovery in the markets, but also a massive weakening of the dollar. As a result, European markets have clearly outperformed in dollar terms since the beginning of the year, even though US indices such as the S&P 500 have repeatedly climbed to new all-time highs in recent weeks.

Read more Close

There are prices that are usually only viewed in dollars: crude oil (-4% since the beginning of the year), gold (+28%), Bitcoin (+22%) and, of course, US stock indices. It is also interesting to look at global developments in dollars. First, let’s take a look at the dollar itself.

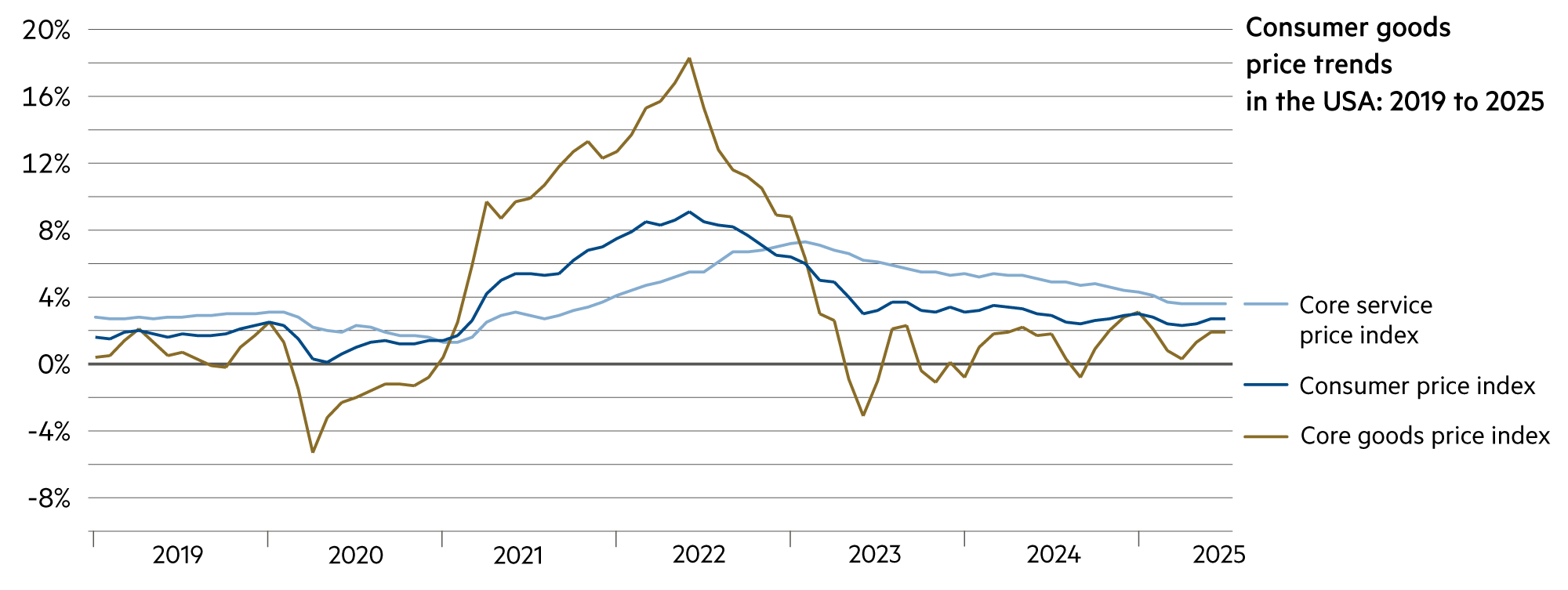

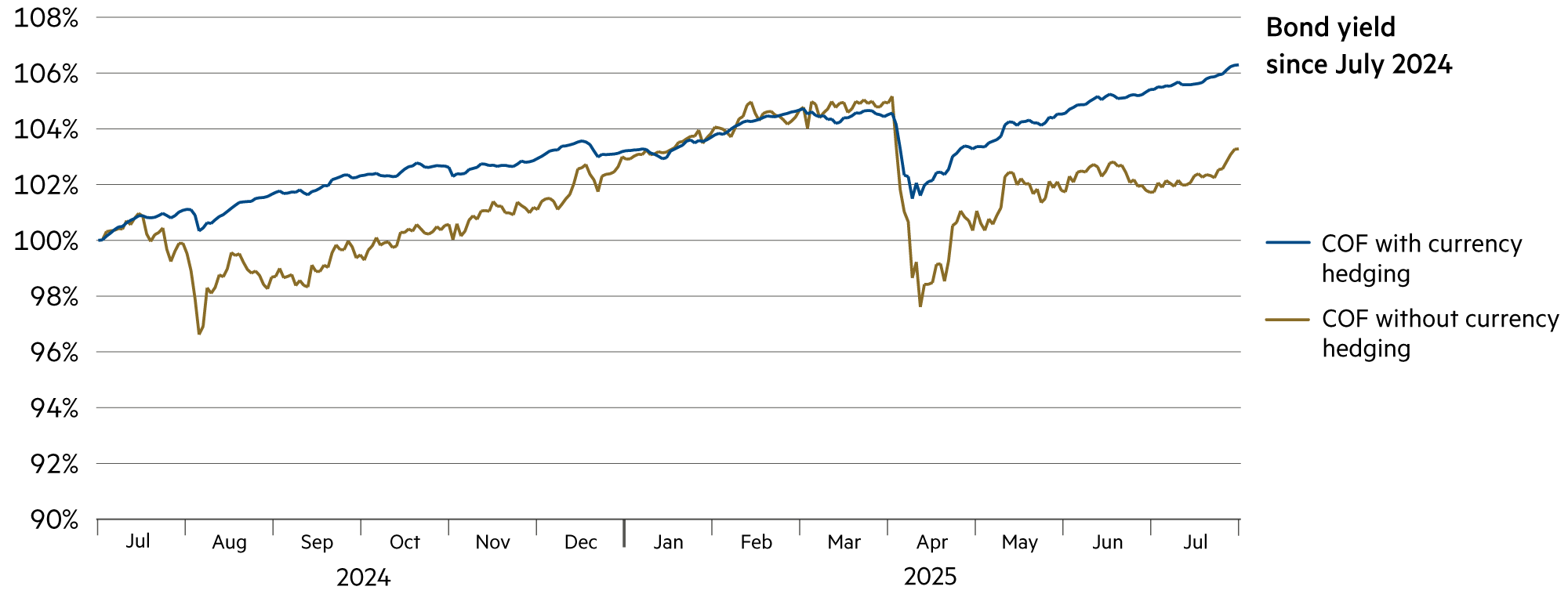

Inflation in the US remains significantly higher than in Europe, and particularly in Switzerland. This means that the dollar is set to depreciate. To hedge against this depreciation, annual premiums of 4.4% would be required. This would have paid off over the course of this year, as the dollar has already depreciated by 10.5% against the Swiss franc. However, it now seems to have found a floor, at least temporarily, at around 0.80 Swiss francs per dollar.

Nevertheless, investors who invested their capital in dollars on the global stock markets in the first half of the year were able to achieve returns in Europe that were slightly higher than those in the Swiss Market Index (+17%) thanks to the broad Stoxx Europe 600 Index (+22%). The broad MSCI Emerging Markets index (+18%) still outperformed the Japanese Nikkei (+9%).

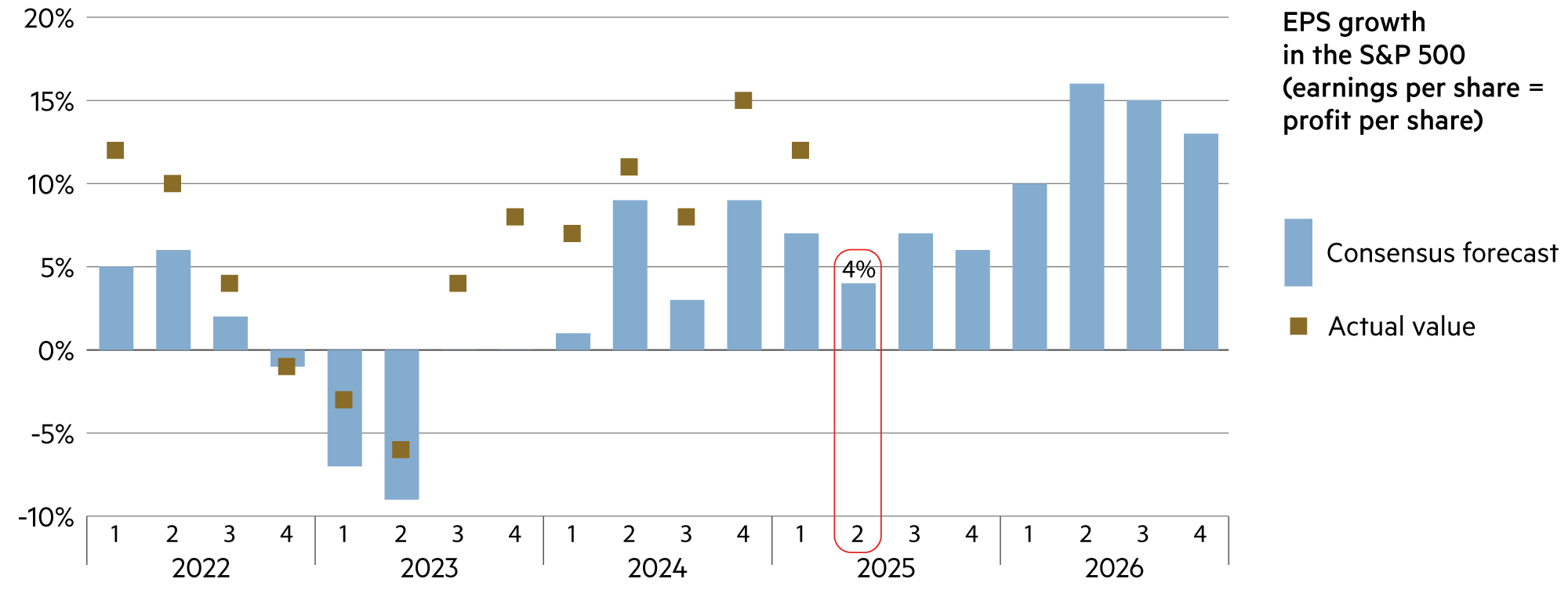

The US S&P 500 Index (+8%) lagged behind many major stock indices. This is rarely the case: The outperformance of European equities relative to the US is the highest in more than 50 years (1973). Back then, too, the massive decline in the value of the dollar was the main reason for the difference in returns.

This is unlikely to change again unless the dollar regains strength. However, the US government has no interest in this, and even the globally active US tech giants are indifferent: they now generate 55% of their revenues outside the US, which means that their revenues and profits in dollars automatically rise and shine. More and more Swiss companies are also reporting in dollars because they do not want to expose themselves to exchange rate fluctuations in their most important currency (Nestlé, Roche, Novartis, Zurich, UBS, ABB, etc.).

Finally, a word on currency and liquidity: Switzerland would be well advised not to allow itself to be labeled a currency manipulator by the US government as a result of heavy intervention in the foreign exchange market. The SNB lowered its key interest rate to 0.0% as of June 20, 2025. Under the current rules, certain commercial bank giro accounts already incur costs of 0.25% per year.

Due to regulatory liquidity requirements, commercial banks must maintain significantly larger liquidity buffers for certain customer segments for deposits that are available at any time. Interest rates were therefore reduced to -0.25% per annum, meaning that negative interest rates were reintroduced on some Swiss franc accounts at several Swiss banks last month.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

The supply of cash is shrinking rapidly: fewer and fewer ATMs are in operation, while digital payments are increasingly replacing bank branches. |

| Euro / Swiss franc |

|

|

Financial stability in the eurozone remains intact. At 0.93, the euro is relatively stable because it has also appreciated by 12% against the dollar since the beginning of the year. |

| US dollar / Swiss franc |

|

|

The dollar remains weak. The spot rate is around 0.80, and the two-year forward rate briefly fell to just 0.73, a historic low. |

| Euro / US dollar |

|

|

The dollar empire is eroding. We are currently witnessing a remarkable shift in power on the global currency markets. |