Liquidity, currency

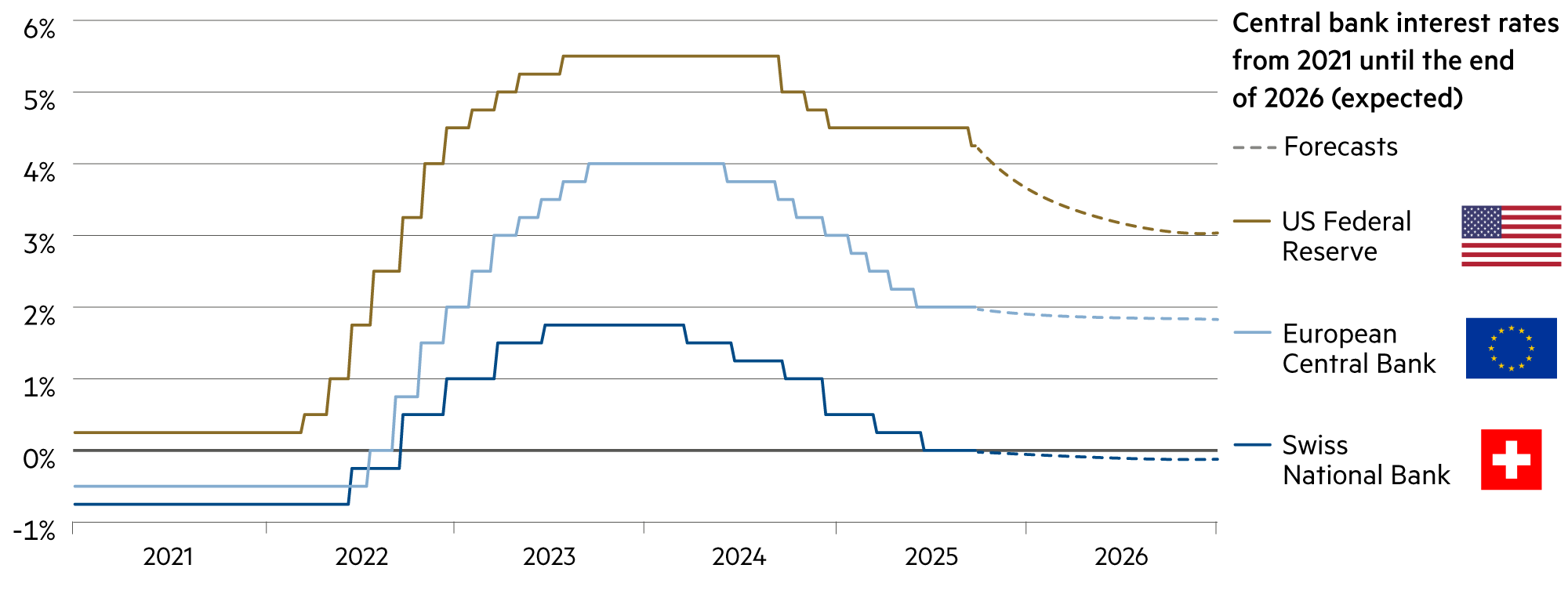

The cycle of key interest rate cuts is almost complete

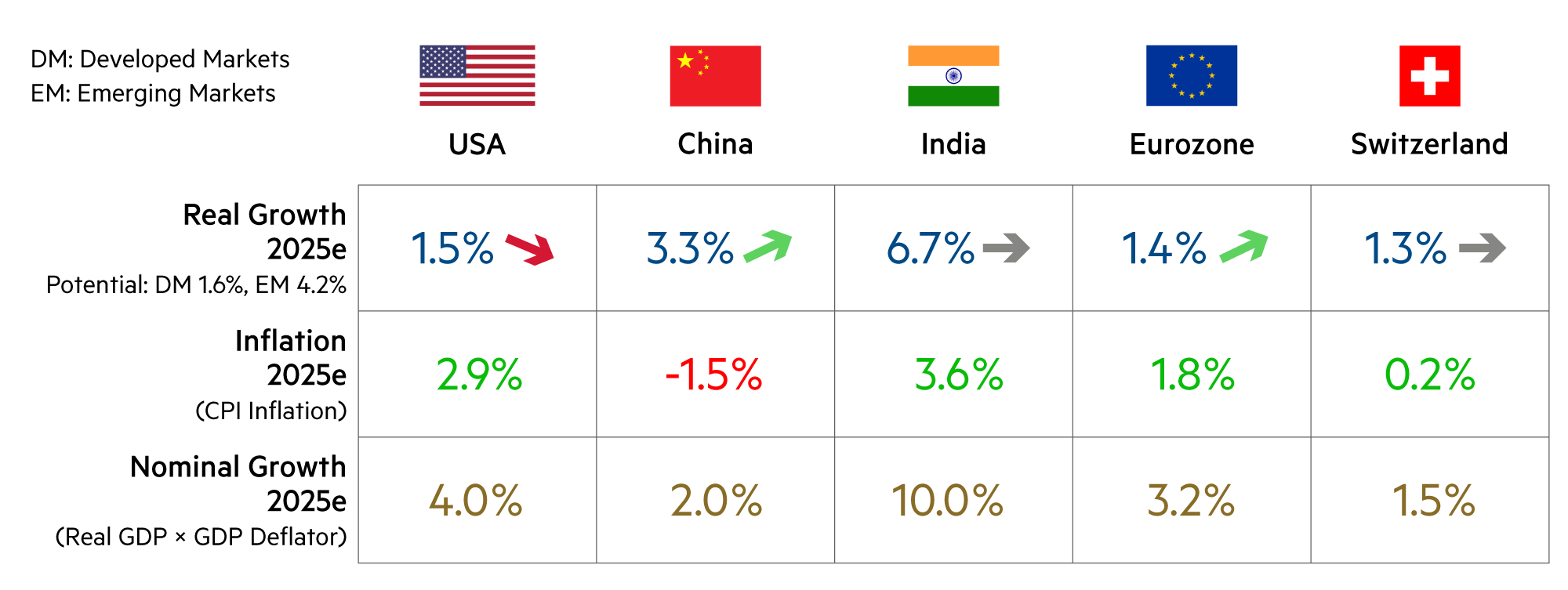

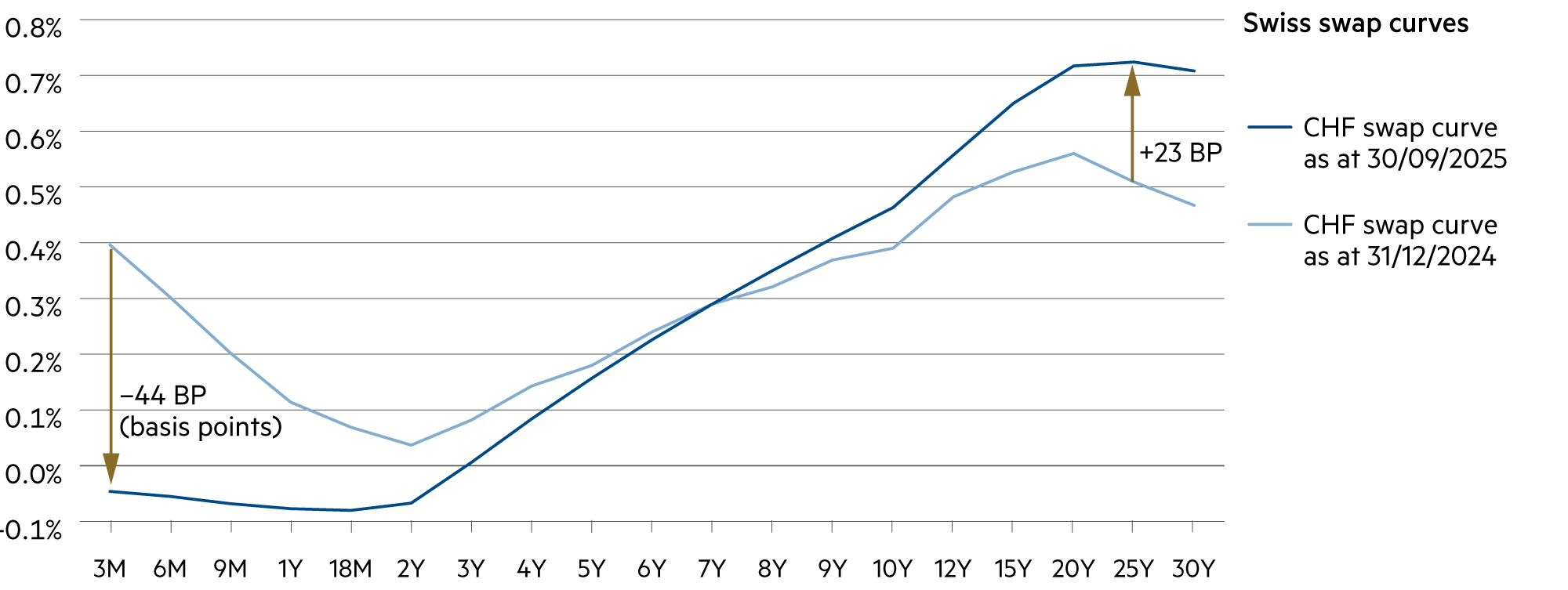

After sharp, inflation-driven increases in key interest rates from spring 2022 onwards, the peak was already reached in fall 2023. The first cuts in key interest rates began in 2024. This cycle is largely complete in Switzerland and the eurozone. Only in the US do we expect a further cut of around 4% to around 3% in the coming 12 months.

Read more Close

The US Federal Reserve (Fed) continues to pursue a restrictive monetary policy, but in September, after a lengthy pause, it resumed its path toward a neutral key interest rate level. One reason for this is that the labor market is showing signs of weakness. The Fed has a mandate to ensure full employment through its monetary policy.

This endeavor has received more attention again at recent meetings. In addition, the inflation rate of 9.0% (June 2022) has fallen rapidly. In August 2025, it was still at 2.9%, with core goods inflation oscillating around 0% over the last twelve months. The main driver of inflation remains housing, and this is precisely what the Fed has control over: when key interest rates fall, housing costs also fall and the inflation rate continues to decline. The pressure from the White House on the long-inactive Fed is therefore entirely justified.

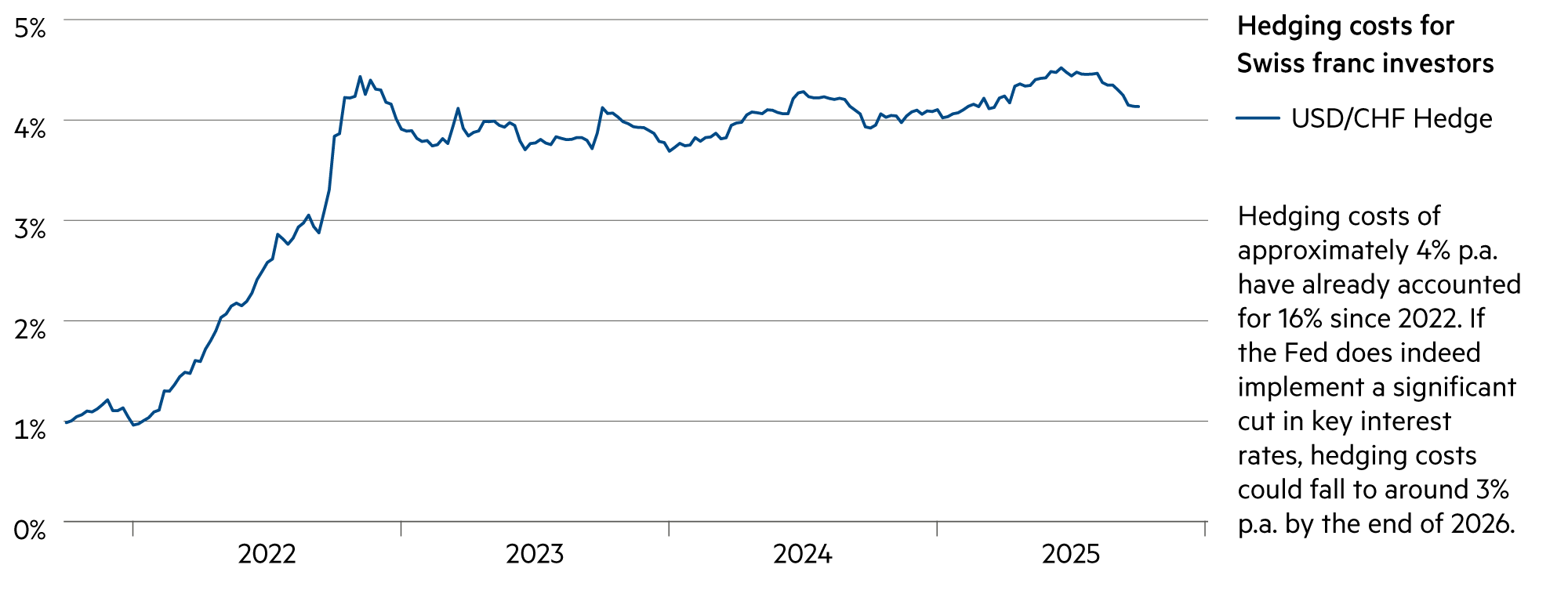

The capital market currently expects four further interest rate cuts in the coming twelve months. This would effectively bring the key interest rate down to 3.1% and would ease a number of conditions, not only in corporate financing (debt capital through bank loans and bonds).

With the Fed’s key interest rates, mortgage rates would also fall, for example, and rental apartments would become cheaper. In addition, leasing rates (currently averaging around 7.5% p.a.) and credit card overdrafts (currently around 22% p.a.) would incur lower interest rates, as would high student loan debts.

More than 50 million young and older people have incurred debt during their college and university years to pay for their expensive education. Many graduates start their professional lives heavily in debt and then struggle to service the interest on their loans and repay the debt.

Currently, outstanding debt amounts to more than $1.8 trillion. Education may be a gateway to social advancement, but for too many people, this promise collapses under the weight of debt.

In other words, the Fed holds the monetary policy key to making life much easier for American households. This is urgently needed, as the middle class is still reeling from the wave of inflation in recent years, which has forced it to dip into its savings to pay all its bills.

In the US, 50% of consumer spending now comes not from the middle class, but from the top 10% of households in terms of income. Specifically, these are households with an annual income of $250,000 or more. The dependence of economic growth in the US on the purchasing power of the rich has never been so high.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

The Swiss National Bank is unlikely to change its key interest rate of 0.0% in the next 12 months. This will also render bank interest rates obsolete. |

| Euro / Swiss franc |

|

|

Financial stability in the eurozone will only be maintained if growing doubts about the ability to implement reforms can be convincingly countered in the near future. |

| US dollar / Swiss franc |

|

|

The dollar remains weak, as does, unfortunately, Europe's dependence on hardware and software, data centers, and satellite communications from the US. |

| Euro / US dollar |

|

|

The euro has gained 13.3% against the dollar since the beginning of the year. At 1.17, it is trading at roughly the average level of the past 25 years. |