Liquidity, currency

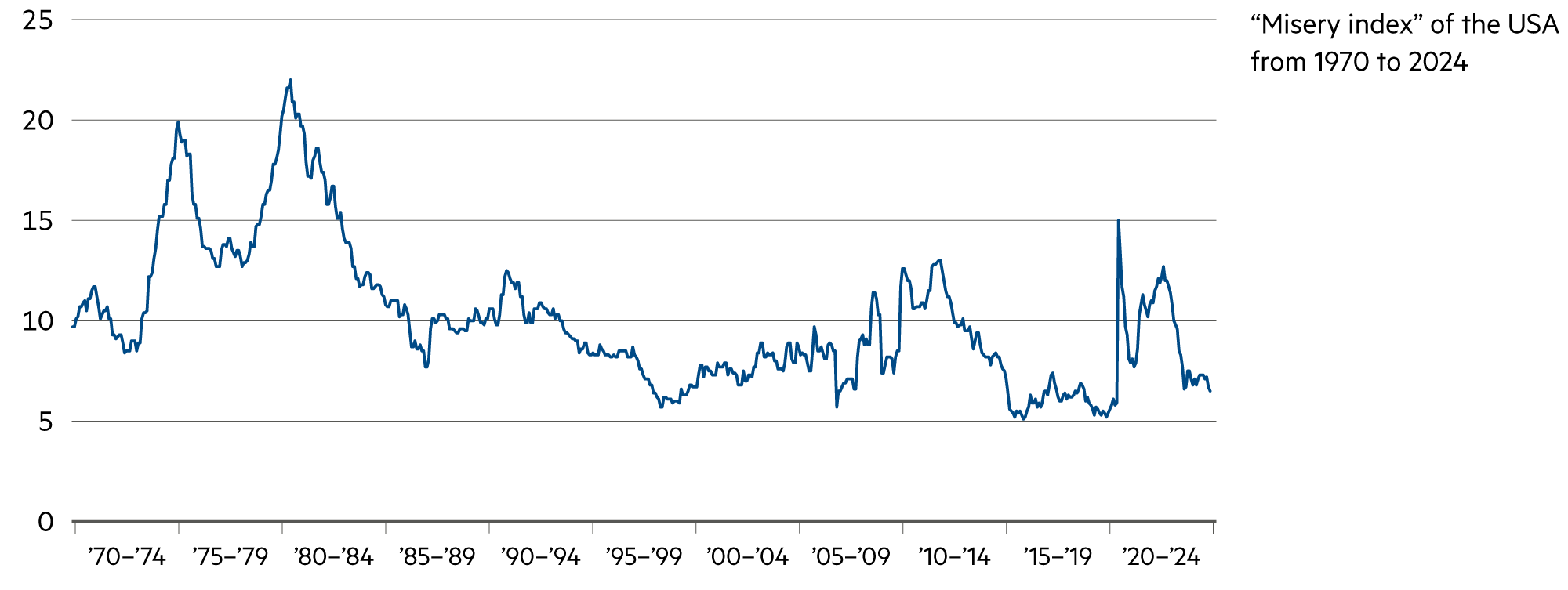

The big wave of inflation is over

The worst phase, with inflation rates in the US and Europe sometimes in double digits, is over. At present, many economies are well on the way to achieving their inflation targets on a sustainable basis. This also applies to Switzerland, where the inflation target is in the range of 0% to 2% and the inflation rate over the past 12 months was 0.6%. Therefore, even the central banks – such as the Federal Reserve (Fed) – are forecasting falling key interest rates in the coming quarters.

Read more Close

The capital market is currently expecting US key interest rates to be cut five times by 0.25% each time over the next 12 months – to a target range of 3.5% to 3.75%. This means that the market is not quite as optimistic as the Fed. The differences are not large, and individual macroeconomic data can quickly change the market opinion again.

The biggest change was the strong growth in the US, which can also be attributed to robust consumption and the low savings rate. Many fail to understand the fundamentally different savings behavior between the US and Europe.

In the US, saving is primarily done with equities, while in Europe low-yield bank savings solutions predominate. When stock markets rise (the broad US S&P 500 index is up around 20% in the current year), there is a significant wealth effect. Anyone who set aside $200’000 at the beginning of the year now has $240’000 – without any additional savings.

In Europe, bank savings are particularly popular. In Germany alone, 2’200 billion euros are parked in demand deposits or cash: only a fraction of this is invested in equities. This has devastating long-term consequences, also this year: those who had 200’000 euros will end up with between 204’000 and 208’000 euros, depending on the account solution. This does not even compensate for the loss of purchasing power due to inflation.

To achieve the individual savings target, considerably more must be set aside with this investment solution. Only in this way can the gap to the typical US household be reduced. The propensity to consume is therefore lower, which hardly encourages companies in this country to invest more. By contrast, robust consumption is the key growth driver of the entire US economy because it encourages companies to invest.

Furthermore, although the US, with 350 million inhabitants, has a lower sales potential than Europe, with almost 600 million inhabitants (excluding Russia), the market is fairly homogeneous from coast to coast. By contrast, Europe’s economy is fragmented into numerous countries with different regulations, languages, cultures, and trade and economic alliances.

However, this diversity also gives rise to a rich culture of innovation. Europe can certainly benefit from geoeconomic fragmentation, because the reshoring of production facilities to low-wage Eastern and Central European countries or to high-quality, 24/7 Western European factories is already proving successful in many areas. More people in Europe have jobs than ever before. At least this is a sign of a good degree of resilience.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

Interest on time deposits is falling sharply and is trending towards 0.5%. With inflation at 0.6%, this is less than the rate of price increases. |

| Euro / Swiss franc |

|

|

The ECB is likely to cut its key rates further at its next meetings (December 12, January 30 and March 6) by 0.25% each time. |

| US dollar / Swiss franc |

|

|

The dollar is trading at a forward rate of 80 cents at the end of October 2024, i.e. despite high interest rates, there is a significant risk of depreciation. |

| Euro / US dollar |

|

|

At 1.09 at the beginning of November, the exchange rate is back in the middle of the range of the past 12 months. We will probably see a little lighter Euro. |