Liquidity, currency

Different inflation outlooks

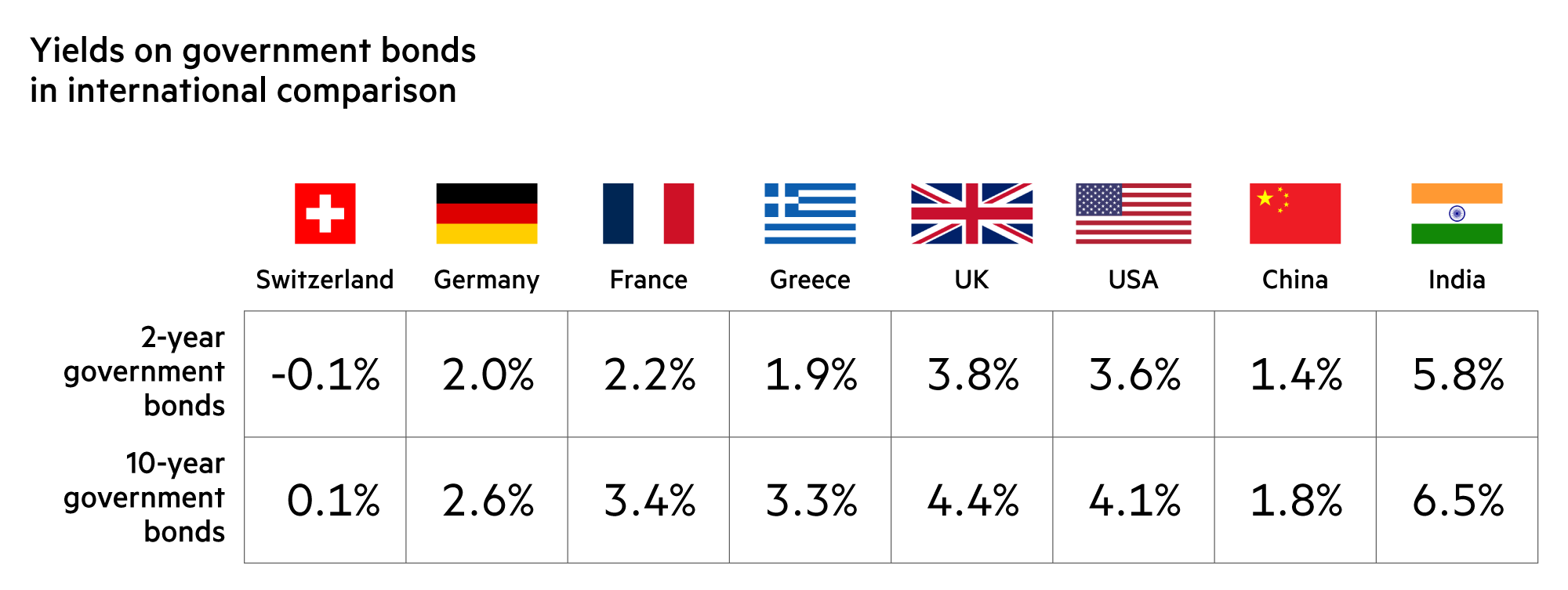

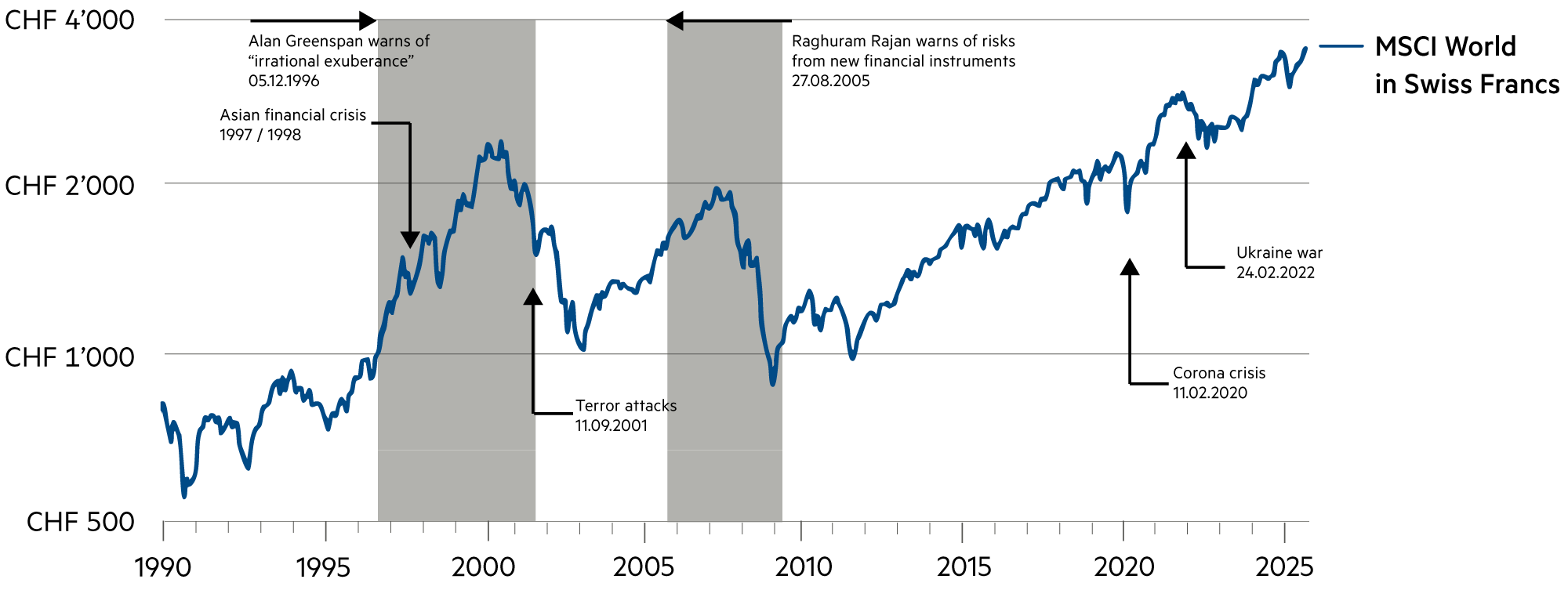

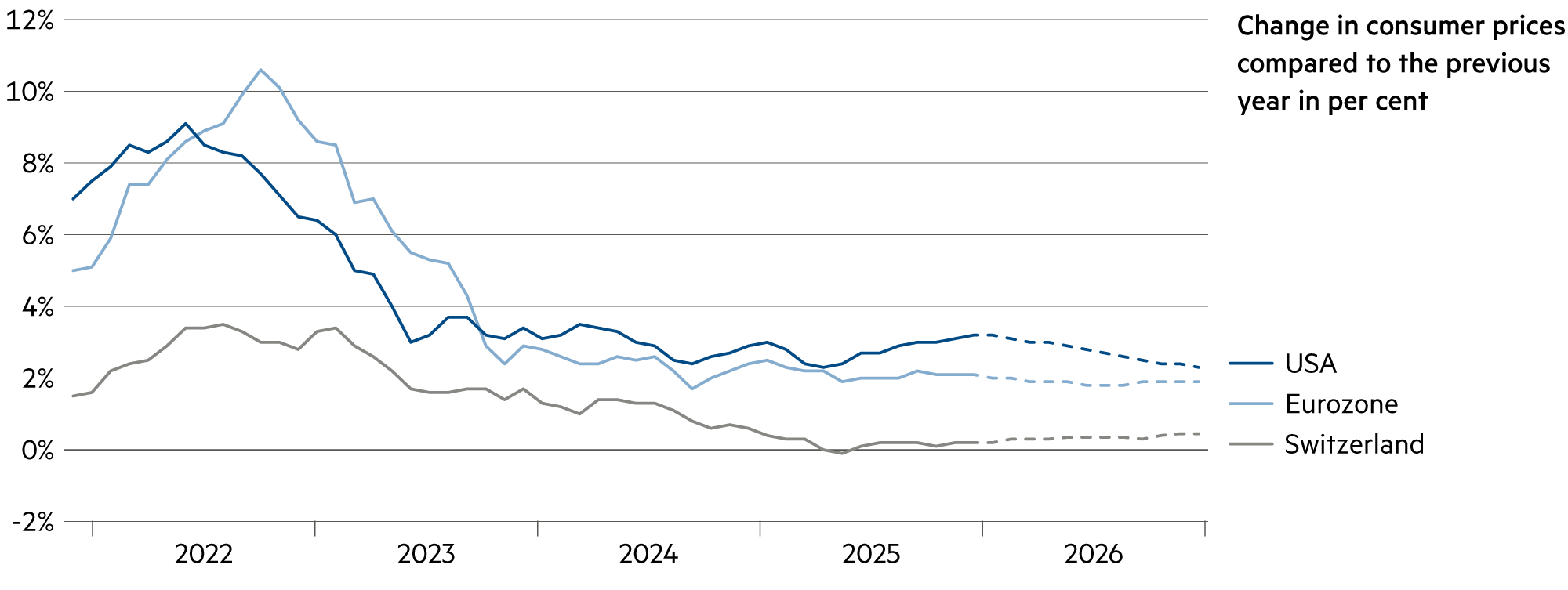

Following the sharp post-pandemic rise in inflation in 2022, prices rose less sharply in the following years. In Switzerland, the inflation rate is only slightly above 0%, which is why the Swiss National Bank (SNB) left its key interest rate unchanged at 0% in September. In the eurozone, the inflation rate is close to the target of 2%, and in the US it is likely to remain elevated for some time.

Read more Close

Inflation in Switzerland could certainly rise slightly in the coming quarters, but it is likely to remain below 1% for the next two years. This means that price stability is guaranteed in the medium term. However, this is also linked to the forecast that the Swiss franc will remain strong.

The clouding of the economic outlook in the US, as well as weaknesses in the labor market and, increasingly, in consumer demand, are likely to prompt the US Federal Reserve (Fed) to cut key interest rates by 25 basis points at least three times in the next four quarters. This would reduce the key interest rate in the US to around 3.0%. This would roughly correspond to the structurally higher inflation rate and the trend of the dollar depreciating against the Swiss franc by around 3% per year.

In the Eurosystem, which includes the European Central Bank (ECB) and 20 national central banks, the goal is to keep inflation at 2% in the medium term. The inflation trauma was the “Great Inflation” from 1965 to 1982, which caused continuous currency devaluations. In Italy, for example, where the lira had climbed to astronomical heights, there were hardly any banknotes with a value of 500’000 lire left, but calculating large sums caused difficulties for many people.

In 1999, Italy joined the euro exchange rate mechanism, and in 2002, the lira was finally replaced by the euro. This enabled Italy, like many other countries, to gain confidence in a currency and maintain purchasing power for the first time in its history. Today, 83% of Europeans support the euro, both as a means of payment and as a tangible sign of shared goals and visions. Most recently, the euro has gained strength, particularly against the US dollar. Foreign issuers are increasingly issuing bonds in euros.

Trust in a currency is still not a given everywhere. In Turkey, for example, inflation rose to over 80% in 2022 due to President Erdoğan’s insistence on low interest rates. This eroded the value of the Turkish lira, undermined the confidence of the impoverished population, and led to instability. Later, the Turkish central bank initiated a change of course and raised interest rates sharply in 2023 and 2024. This helped to reduce inflation, but it remains high at over 30%.

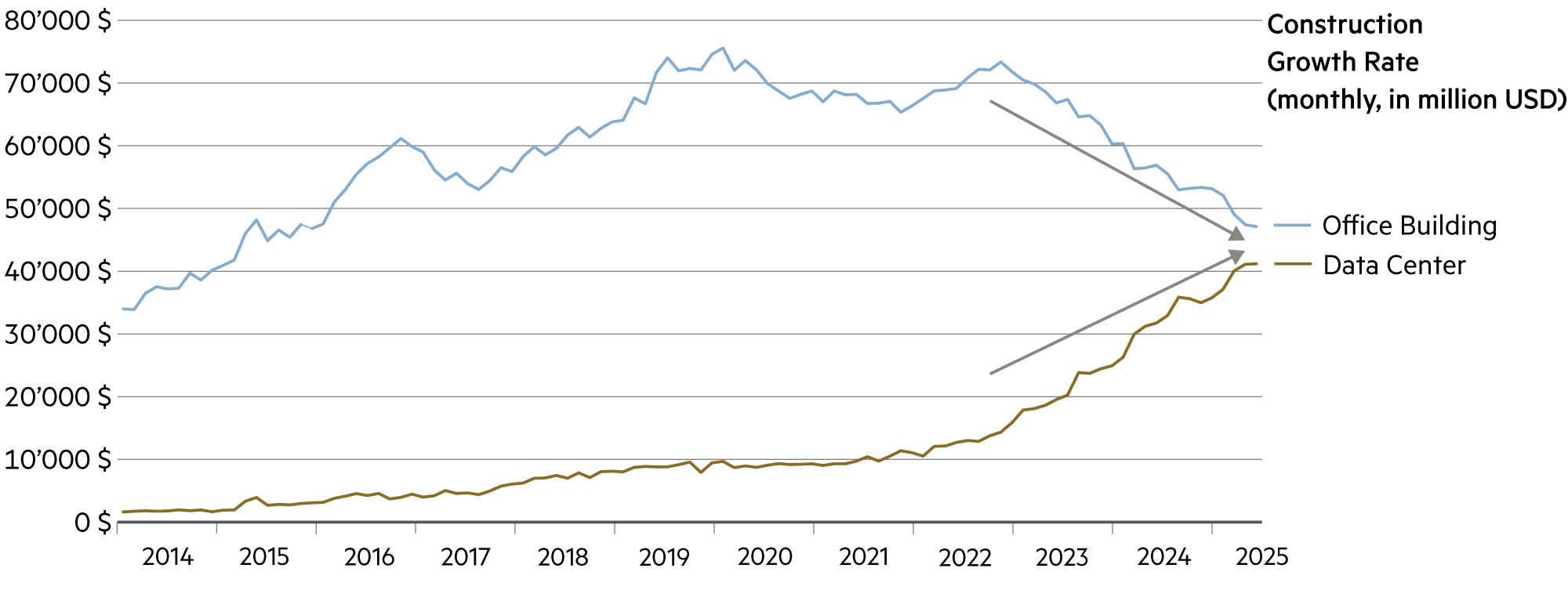

A stable currency alone is not enough. To be innovative and remain competitive in the long term, every economy must renew its capital stock. Decisive action is needed to create conditions that make it easier for companies to invest, i.e., by removing bureaucratic hurdles, reviewing regulations, and speeding up approvals. Labor market and education policies are also part of this, and venture capital is needed as a driver of growth.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

We expect the SNB's key interest rate to remain at 0% even after the monetary policy assessment in December – bank interest rates do not exist as such. |

| Euro / Swiss franc |

|

|

Financial stability in the eurozone is certainly greater than in the dollar area, but more needs to be done to return to moderate growth. |

| US dollar / Swiss franc |

|

|

The weakness of the dollar is also evident in its role as a global reserve currency: since 2014, its share has fallen from 62% to 56% (the euro remained at 20%). |

| Euro / US dollar |

|

|

The euro could massively improve its position if the fragmented capital market and structural weaknesses in the financial sector were overcome. |