Individual investment concept tailored precisely to your needs

The semi-autonomous arrangement leads to fewer restrictions due to regulatory requirements. This allows you to take advantage of significantly better return opportunities with the savings capital in the long term. There is the option of an individual custody account or an investment pool.

In the case of the Zugerberg Finanz pension solutions, the insurance component and the savings component are separated and are handled by the respective specialists. Depending on the solution, the collective foundation or the affiliated company determines the investment strategy.

Added value for you

Advantages of Zugerberg Finanz pension solutions

- Tailored pension solutions (pension plans and investment strategies)

- Maximum transparency and cost-effective management

- Low risk premiums

- Individual, active asset management mainly based on individual titles

- Participation in the success of the investment strategy

- Individual selection of risk insurance

- Solutions for pensioner portfolios

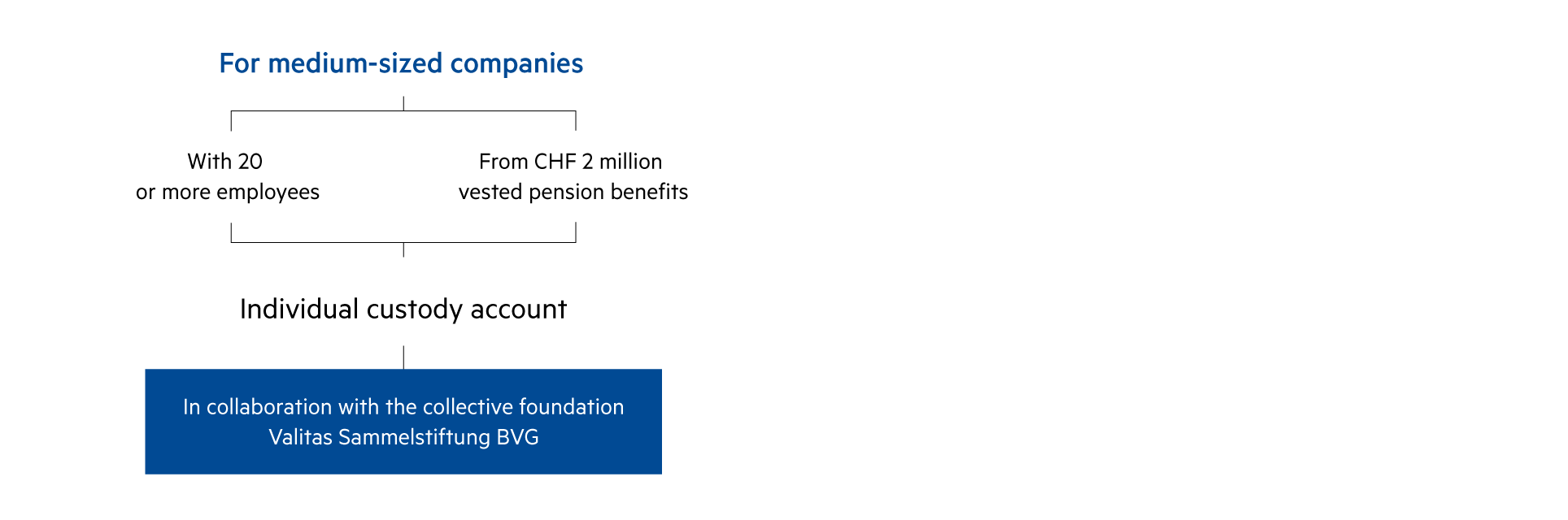

Individual custody account

The individual custody account solution is suitable for companies with about 20 employees or more and / or vested pension benefits of around 2 million Swiss francs. Each affiliated company is managed separately with its own account and custody account. This gives individual companies the freedom to decide how the investment strategy for their vested pension benefits (savings component) should be structured.

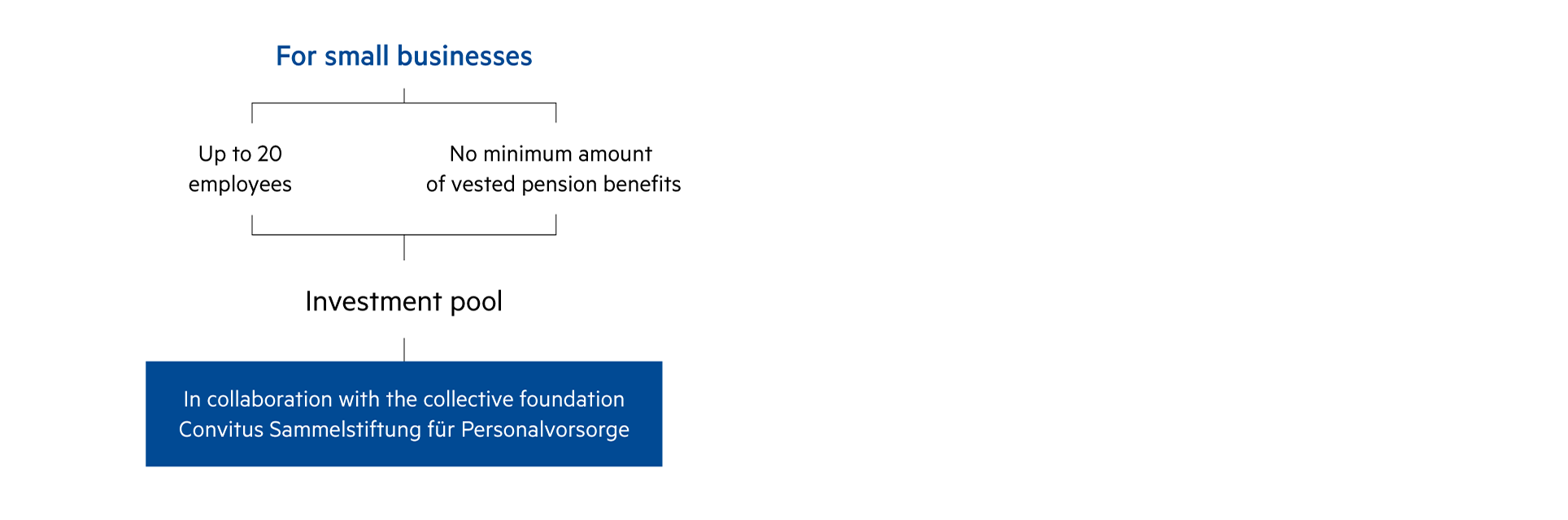

Investment pool

The pool solution is suitable for micro and small companies with up to 20 employees, among others, with no minimum amount of vested pension benefits. By pooling the retirement assets of several companies into a single investment pool, the fees and administrative burden for the asset management company can be reduced. Compliance with the legal and strategic requirements is guaranteed at all times.