Liquidity, currency

The Swiss franc as a strong currency

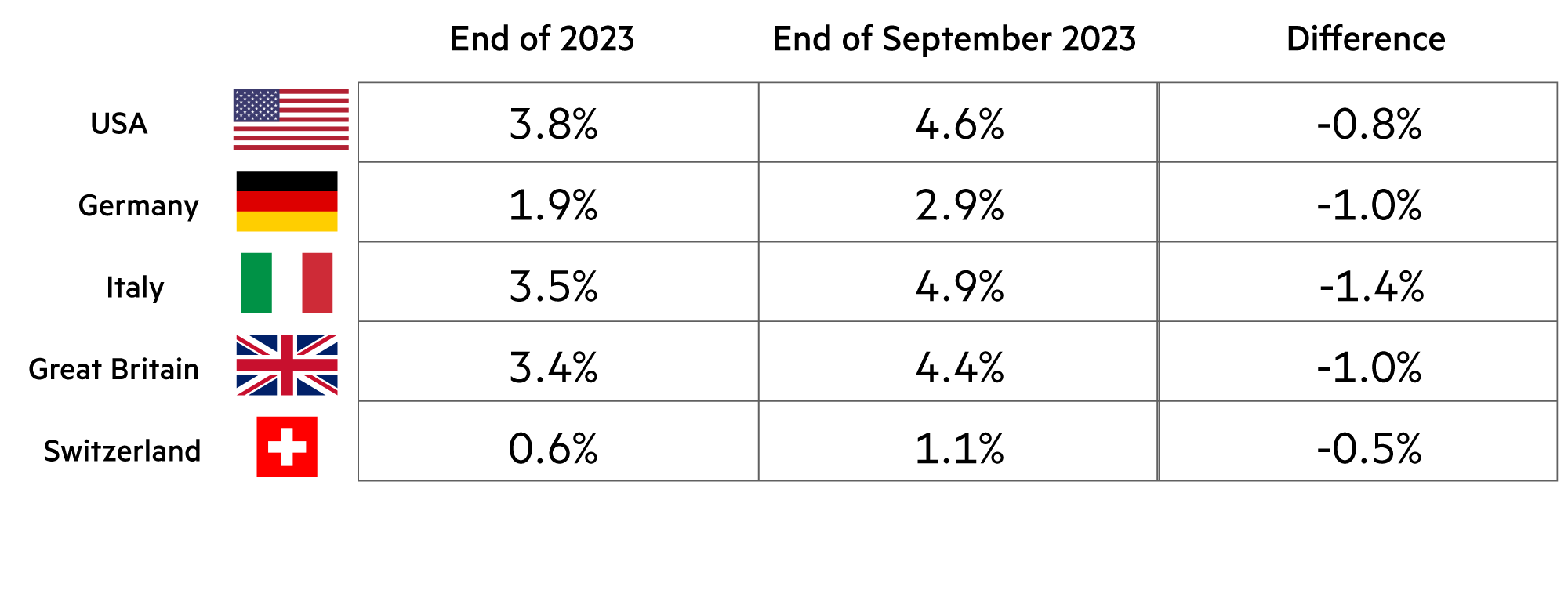

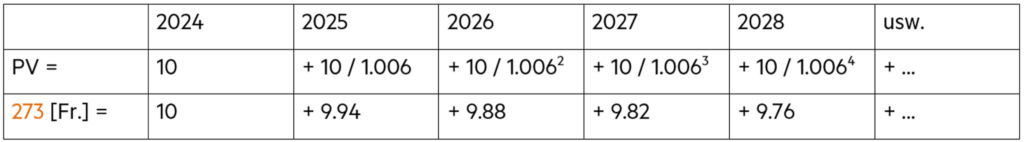

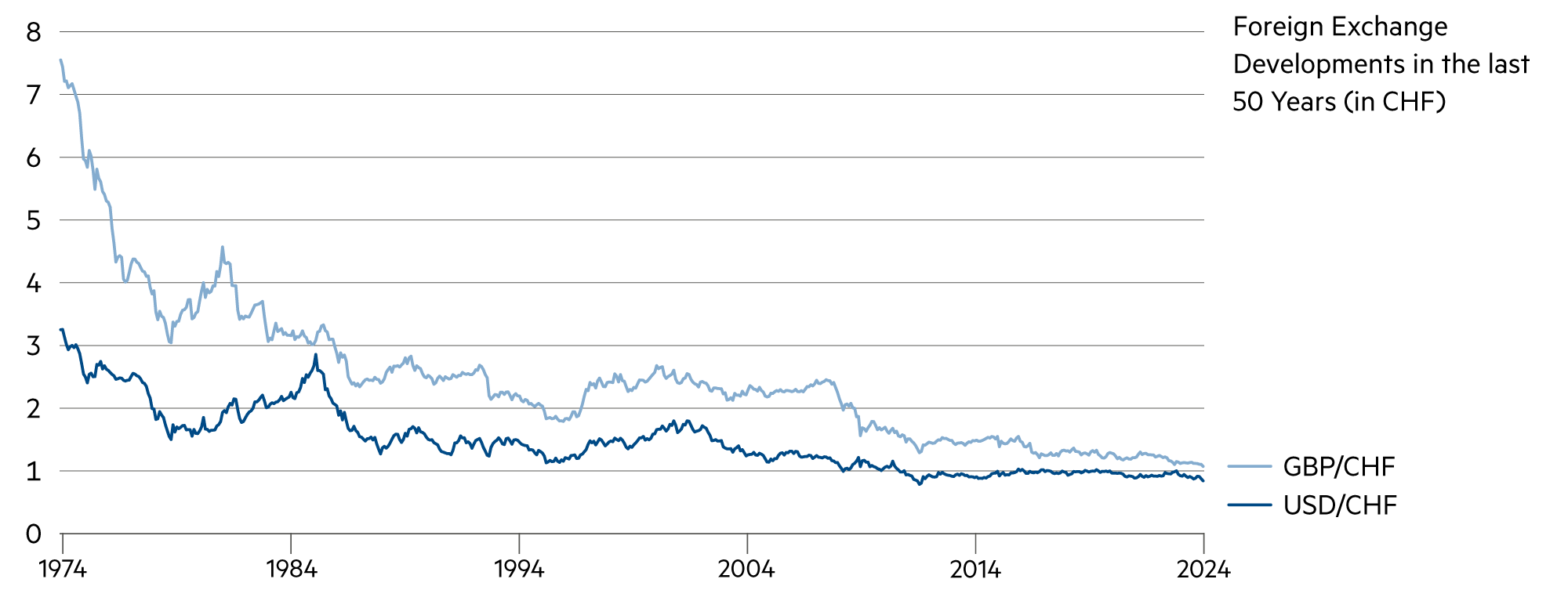

The exchange rate development of the Swiss franc investor was characterized by constant devaluations. The dollar has depreciated by 80% over the last 50 years. In the case of the British pound, it was even 90%. Hedging against dollar depreciation currently costs Swiss franc investors 3.8% a year. The constant devaluations can largely be explained by inflation differences. Because the inflation rate in Germany and the eurozone was lower than in the US, the euro depreciated less.

Read more Close

The Swiss franc was the strongest G10 currency last year, appreciating by around 12.2% against the Bloomberg Dollar Spot Index. However, 2023 is by no means an isolated case, but a very typical year for our small economy with the world’s strongest currency. Because other countries have systematic government budget and current account deficits, which are often accompanied by higher inflation rates, currencies such as the US dollar, the pound sterling and the Chinese renminbi are tending to depreciate against the franc. For investors, these are highly volatile cornerstones of a long-term investment strategy.

In Switzerland, not only politics but also the budget situation is balanced. Monetary and fiscal policy is geared towards stability. The democratically enshrined debt brake is proving to be effective, whereas in Germany, for example, it is not even understood by the government itself. In economic terms, Switzerland regularly achieves trade surpluses. Price stability is so firmly anchored that deflation has repeatedly occurred in recent years. Half of the last 14 years have seen slight deflation: 2009 (-0.5%), 2012 (-0.7%), 2013 (-0.2%), 2014 (-0.01%), 2015 (-1.1%), 2016 (-0.4%) and 2020 (-0.7%). Inflation in 2023 (+1.7% in December compared with the same month of the previous year) is considered relatively high by Swiss standards. The increase in 2023 was due in particular to higher prices for electricity, gas and for housing rentals. In contrast, prices for petroleum products, combined offers for fixed-line and mobile communication and medicines decreased.

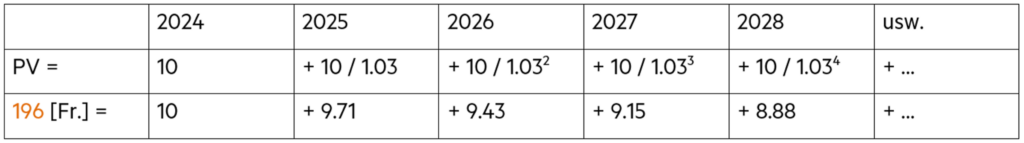

Due to the overall moderate long-term inflation path, the Swiss Confederation can offer long-term capital at favorable conditions. Switzerland remains a haven of stability and solidity. This is why bond investors receive a yield of just 0.6% on ten-year Swiss bonds at the end of the year. In early January 2024, yields have increased some 20 basis points on average and moved the benchmark yield upwards to 0.8%.

Abroad, comparable government bonds offer much higher yields (January 11, 2024): 4.0% in the US, 4.1% in Australia, 3.8% in Italy, 3.8% in the UK, 3.3% in Greece and 2.2% in Germany. However, we advise against investing in such bonds in general, as there is not much left after the cost of currency hedging.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

Anyone seeking long-term returns above the inflation rate in Switzerland (+1.4%) should invest surplus liquidity in a securities portfolio. |

| Euro / Swiss franc |

|

|

At 0.93, the FX rate has realistic upside potential in the current year – even though inflation expectations are more firmly anchored in Switzerland than in the Eurozone. |

| US dollar / Swiss franc |

|

|

Depending on the method of calculation, purchasing power parity is still around 10% lower than the current level of 0.84. The dollar still has downside potential. |

| Euro / US dollar |

|

|

The euro is 25 years old. Contrary to popular belief, the euro's exchange rate of 1.11 is almost at the same level as at the beginning of January 1999. |