Liquidity, currency

China is not an attractive investment country

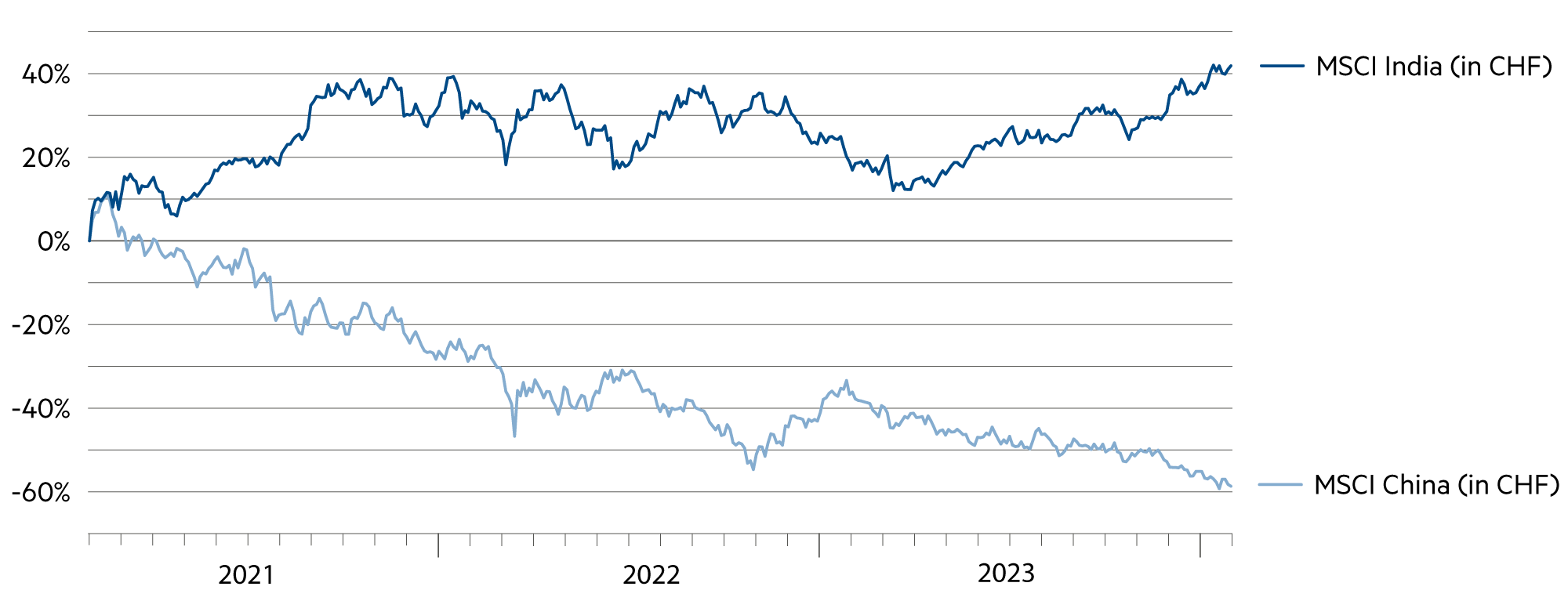

We continue to steer liquidity into solid values in all portfolios. We have given China a wide berth for years. A distinction must always be made between macroeconomic development at country level and the business model-related level of a company. The last three years have undoubtedly been a difficult and frustrating time for investors and market participants in Chinese equities, as this has been associated with a 58% decline in share prices.

Read more Close

China’s stock market has long lagged well behind its global competitors. Since joining the World Trade Organization in 2001, China’s GDP has grown 13.6-fold, from around USD 1.3 trillion to around USD 17.7 trillion in 2023. This corresponds to an annual growth rate of +12.5%. In the same period, the Shanghai Composite only doubled (= annual growth rate of only +3.3%). The startling difference between the economy and equity goes back to the communist system, where the economic priority is not the wealth of equity owners.

We still don’t think much of the Chinese framework. There is no shareholder culture, in fact the state regularly forces companies to pay higher wages. The examples of Alibaba, Tencent and Baidu also show how the state intervenes directly in the shareholder and management structure.

In India, on the other hand, all the signs are “green”. Due to its market capitalization, the Indian stock market is now the fourth largest country market in the world. The government is promoting entrepreneurship and economic conditions through the largest infrastructure program in recent decades. The risk/return ratio for Indian equities remains favorable for patient investors.

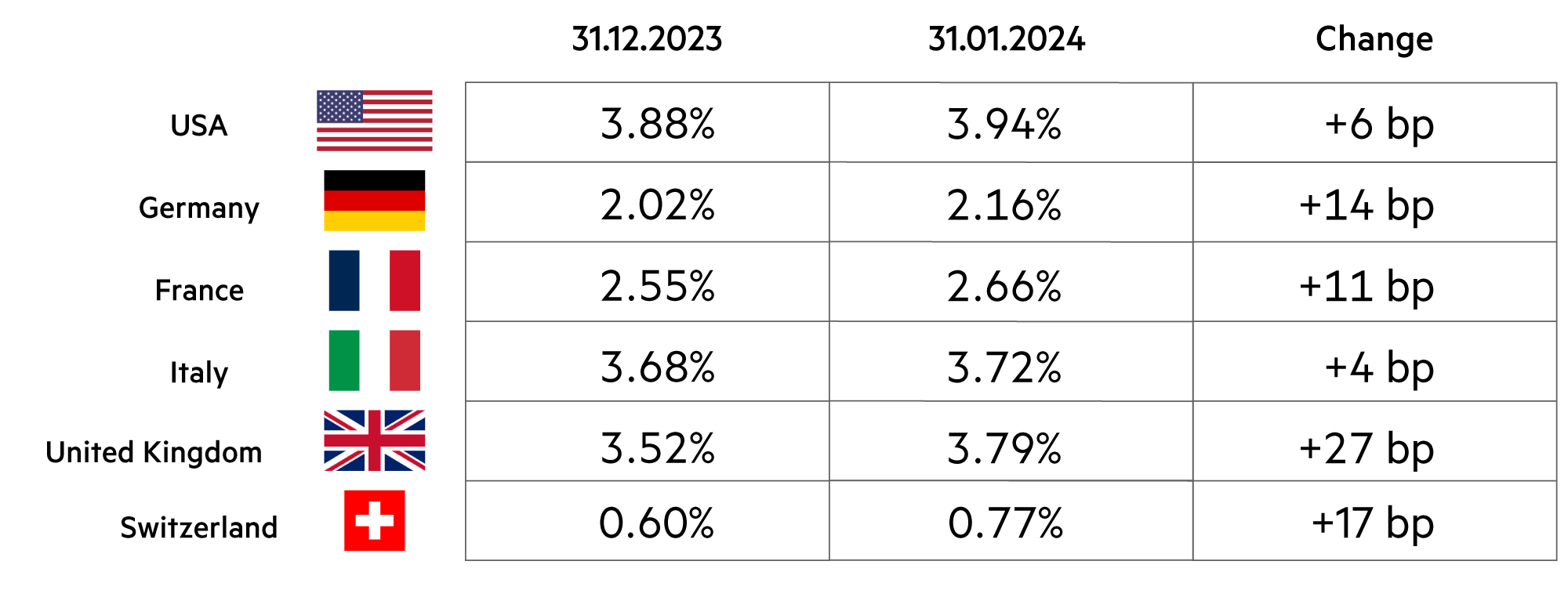

The weighting is not large, but as part of a satellite in the overall portfolio, Indian entrepreneurship has a rightful place in our portfolios. Over the past three years, the difference in index performance converted into Swiss francs between the MSCI India (+38%) and the MSCI China (-58%) has grown to a whopping 96%.

Switzerland’s negotiations on a free trade agreement with the world’s most populous country are a fitting example of this. A basic agreement has been reached. Patent protection was controversial; investments are also to be better protected. An agreement with India should create jobs for India’s young population and secure Switzerland as a business location. Access to India’s “talent pool” is important for many Swiss companies. The country has a large number of well-qualified, English-speaking young adults with strong digital skills.

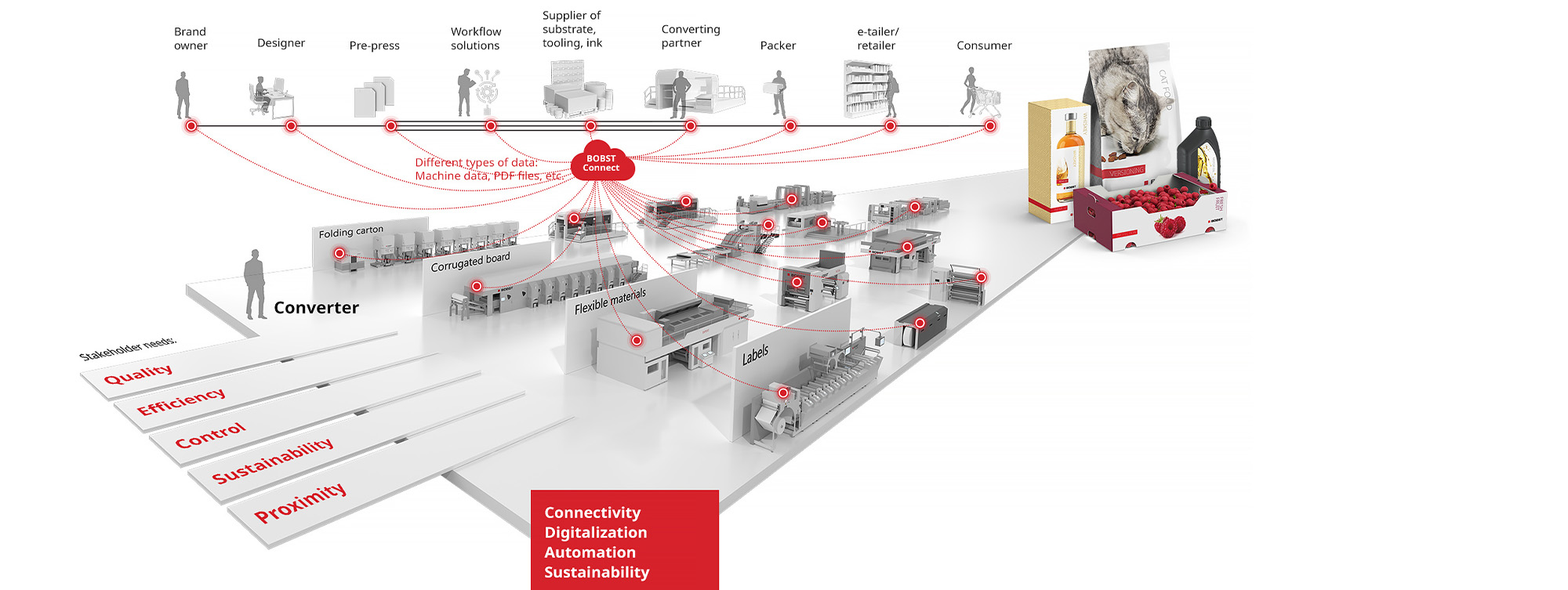

For years, Western companies relied on China as an extended workbench, but this is turning out to be a cluster risk. “The Indian market is becoming the logical alternative to China,” writes Switzerland’s State Secretariat for Economic Affairs in its latest country report. India will take on the role of global production site for low-cost machines, for example, for the French-speaking Swiss machine manufacturer Bobst. The company already employs 400 people in Pune, south-east of Mumbai, and plans to add several hundred more in the next two or three years.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

Inflation expectations are declining. Accordingly, key interest rates are also likely to be cut in Switzerland, which will put pressure on interest rates on bank accounts. |

| Euro / Swiss franc |

|

|

Over the course of the year, interest rate cuts in the eurozone are likely to be more pronounced than in Switzerland, which will significantly reduce hedging costs. |

| US dollar / Swiss franc |

|

|

At 0.86, the dollar gained 2.5% in January. But with hedging costs of 3.8%, they remain at a high level - with a slight trend towards a reduction. |

| Euro / US dollar |

|

|

At 1.08, the most important exchange rate pair is in a zone of relative stability. In the course of normalization, fluctuations are currently decreasing significantly. |