Liquidity, currency

The Swiss franc is oversold

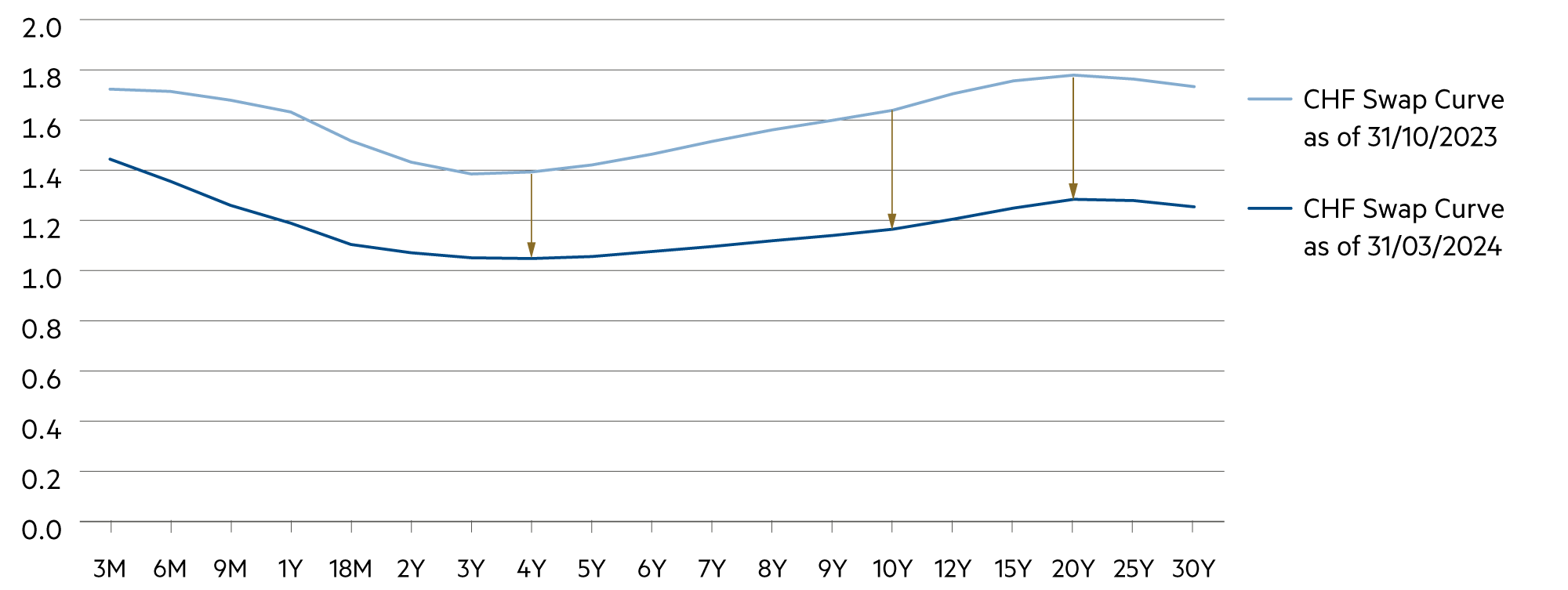

As part of its monetary policy assessment, the SNB lowered the key interest rate by 0.25% to 1.5%. In doing so, it also initiated a weakening of the Swiss franc and a significant reduction in the yield curve across all maturities. We believe that the benefits resulting from the new swap interest rates are considerable. On the other hand, we are convinced that the massive weakening of the Swiss franc in the first quarter of 2024 is more of a temporary nature.

Read more Close

The swap curve is currently at its lowest point at four years, i.e. in the interbank business, four-year contracts are concluded with an interest rate of 1.04% (asking price). For a mortgage loan interest rate, the approximate rule of thumb is that, under competitive conditions, a customer margin of an additional 0.8% must be added for first-ranking collateral in order to arrive at the interest rate of the respective mortgage loan, i.e. a four-year fixed-rate mortgage is currently likely to be offered to the best borrowers at around 1.84%.

In other words, two- to ten-year fixed-rate mortgages are currently available at 2.0% or just below. This is around 0.5% less than five months ago. The market is only expecting a further substantial drop of this magnitude in the money market. The three- and six-month interest rate is currently around 1.4%. It is likely to be slightly below 1.0% at the end of December 2024 and the end of 2025, which can be deduced from the current Saron futures. In other words, the capital market is currently expecting two further key interest rate cuts of 0.25% by the end of the year. Only when these have occurred will the mortgage interest rates on loans linked to the variable Saron money market rate fall.

Even lower key interest rates are not to be expected. It is quite possible that the SNB will declare the “neutrality” of its monetary policy at 1.25%. But there is no certainty. If the real economic trend potential is considered to be +1.25% annually, the key interest rate does not need to be pushed below this level unless there is an economic emergency (e.g. to combat a possible recession).

It is certain that the SNB’s latest decision will have a positive impact on the stabilization of the domestic price landscape (e.g. rents). The temporary weakness against the euro and the dollar is likely to be only of a short-term nature, but will provide immediate relief for the Swiss export industry.

At present, we believe that the SNB’s expectations of interest rate cuts are too high. The need for tightening in times of higher inflation should not be equated with the potential for easing in times of inflation rates between 1% and 2%. After all, these are in the upper band of what the SNB considers to be price stability (0% to 2%). The SNB’s inflation forecast leads to the conclusion that there is a considerable chance that expectations of the SNB will be disappointed. At that point, the franc will appreciate again.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

Falling money market yields are ensuring a sustained inflow of liquidity into long-term nominal and sustainable real investments. |

| Euro / Swiss franc |

|

|

Over the next 12 months, the strong momentum for the euro (+4.8% ytd) is likely to weaken again somewhat. |

| US dollar / Swiss franc |

|

|

In the first quarter of 2024, the dollar made up almost 80% of its loss against the franc in the fourth quarter of 2023, but it remains unstable. |

| Euro / US dollar |

|

|

At 1.08, the world's most important currency pair is exactly 3% higher than six months ago. Inflation rates in the eurozone fell faster than those in the US. |