Liquidity, currency

The USA is decoupling

The yield landscape has changed considerably in recent times. This is due to the fact that the global economy is not moving in sync. The USA decoupled for a while, recording stronger growth rates and therefore more persistent inflation rates than Europe. This results in very different yield differentials, which are currently also having a strong impact on currencies.

Read more Close

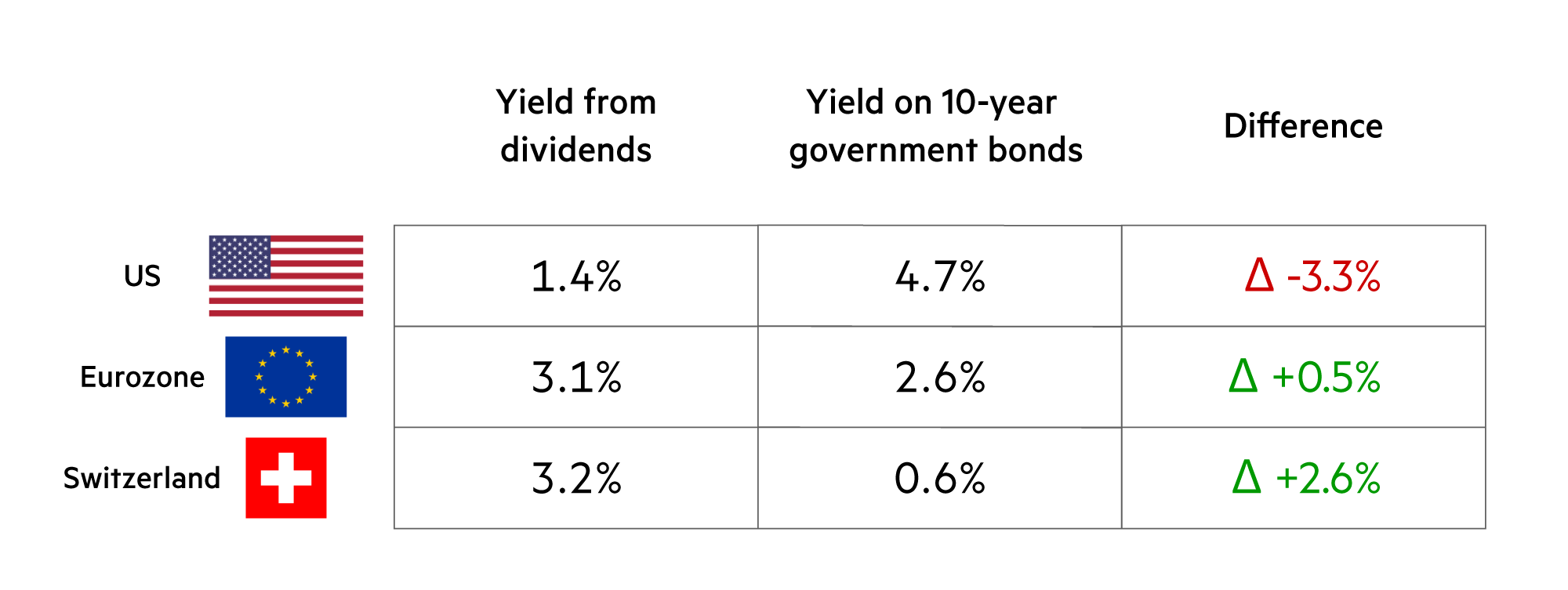

In the USA, the yield on ten-year treasury bonds rose to 4.7% at the end of April. The yield on two-year treasury bonds is now as high as 5.0%. Both are significantly more than you get as a dividend if you invest in US equities. It also explains the strength of the dollar in the first four months of this year. At 0.92, the USD/CHF exchange rate is back at the same level as at the end of September 2023. It temporarily fell to 0.84 when a recession was predicted for the US economy with a correspondingly large number of interest rate cuts.

But this did not happen, on the contrary. At present, there is no longer even talk of a soft landing. If anything, the economic signals are pointing to further expansion, i.e. in terms of the economic cycle, there appears to be a “no landing”. The economy is being pushed by fiscal policy in the last two or three quarters before the important presidential and congressional elections in November 2024 to such an extent that the Federal Reserve’s hands are tied in terms of monetary policy. The strong increases in consumer spending (+2.5% in the first quarter) and especially spending on services (+4.0%) have brought the falling inflation path of 2023 to an abrupt halt. Inflation is particularly persistent in the services sector.

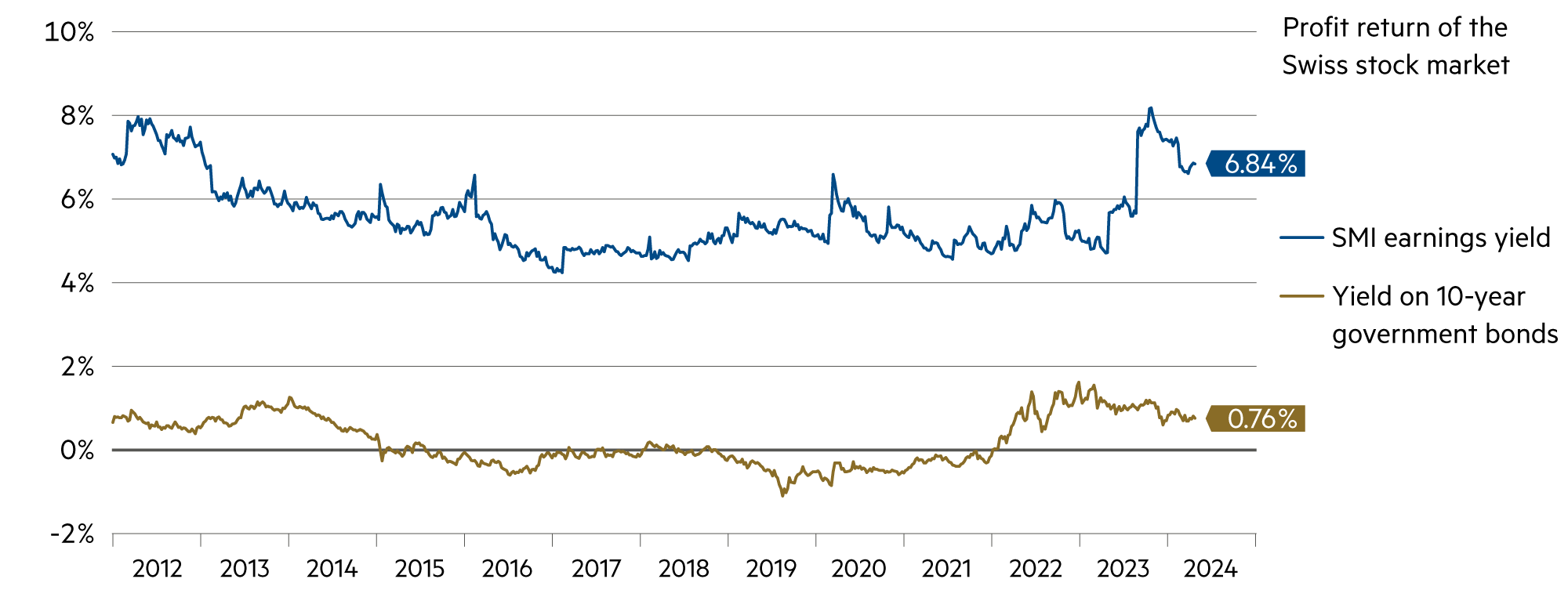

As a result, yields on US treasury bonds have risen from 3.9% to 4.7% since the beginning of the year. This has led to considerable price losses for bonds. In Switzerland, on the other hand, inflation appears to have been successfully combated. In any case, investors on the capital market are content with a 0.6% yield on the ten-year Swiss Confederation bond – as at the beginning of the year. The higher yield caused the dollar exchange rate to rise, but the significantly higher inflation rate means that there is even greater potential for price losses in the medium term.

The stock markets in Europe (with the exception of Switzerland) recorded higher price gains in the first four months than in the USA. On the one hand, this is probably due to the surprising economic recovery in Europe. However, another important factor is the observation that dividends alone generate a higher yield than benchmark government bonds in the eurozone.

In the USA, on the other hand, the dividend yield is significantly lower than the yield that can be safely achieved on the money and capital markets. Accordingly, many are also taking a cautious view of the relatively highly valued US equity markets, while the European markets (including in Switzerland!) are characterized by relatively moderate valuations in view of rising corporate profits and higher profit expectations.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

Low inflation (1.4% in April YoY) gives reason to hope for further interest rate cuts by the SNB. Some banks are already lowering their interest rates again. |

| Euro / Swiss franc |

|

|

The strong momentum for the euro (+5.7% ytd) is likely to continue. The exchange rate is back at the same level as a year ago. |

| US dollar / Swiss franc |

|

|

At the beginning of May, the spot rate was 0.92. On the futures market, the dollar is trading significantly lower (0.88 in 1 year and just under 0.85 in 2 years). |

| Euro / US dollar |

|

|

At 1.07, the euro gains further ground at the beginning of May. Risk-sensitive investors are supporting the euro. |