Liquidity, currency

Fed fund rates will decline

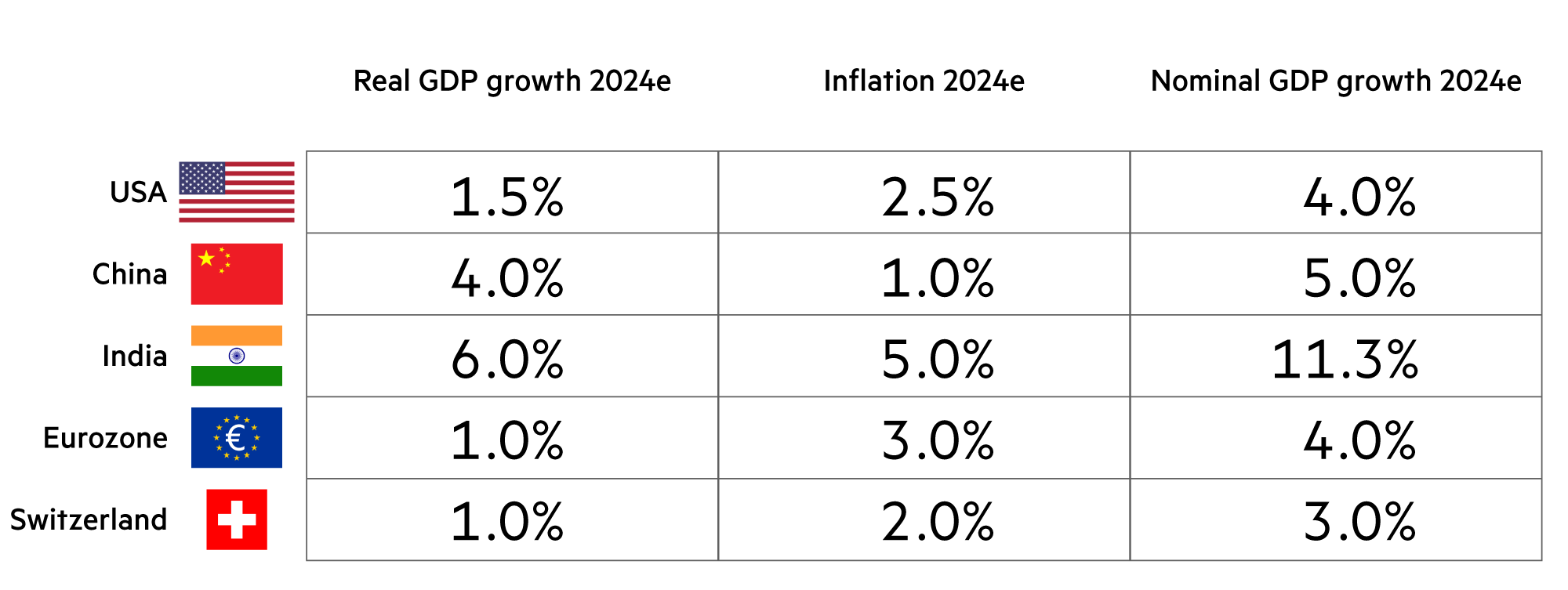

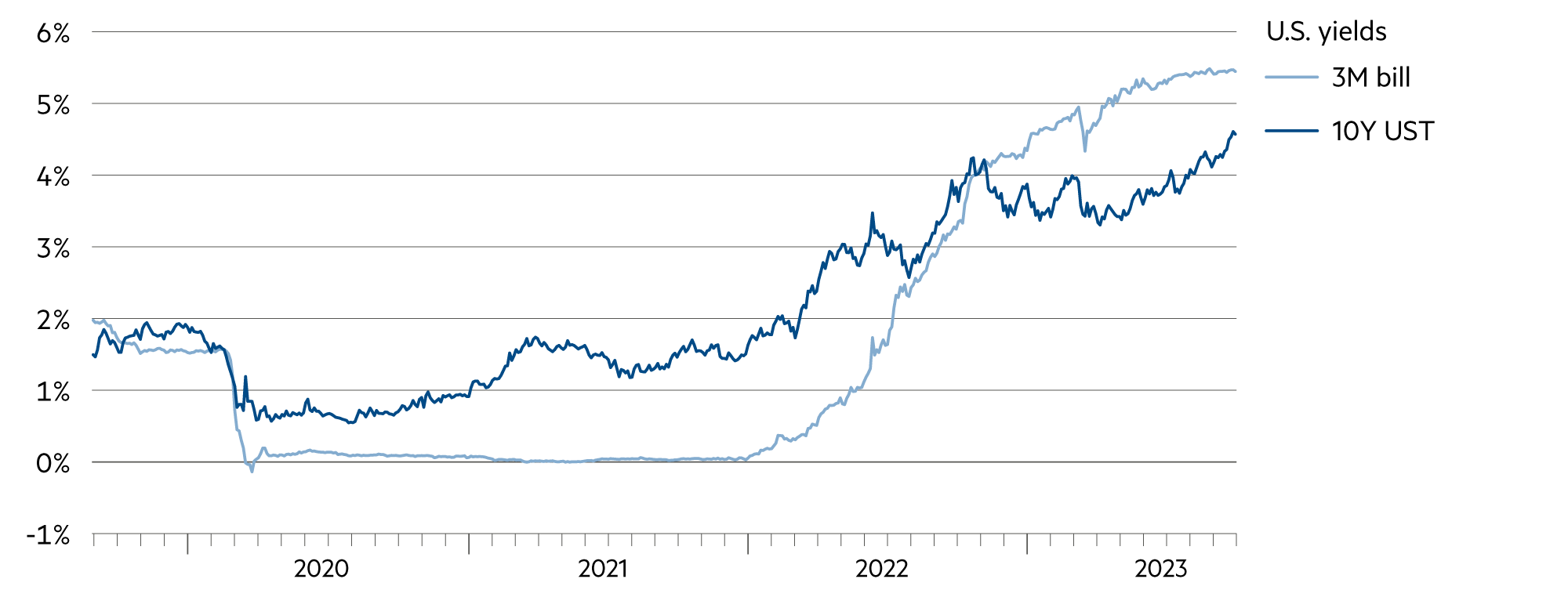

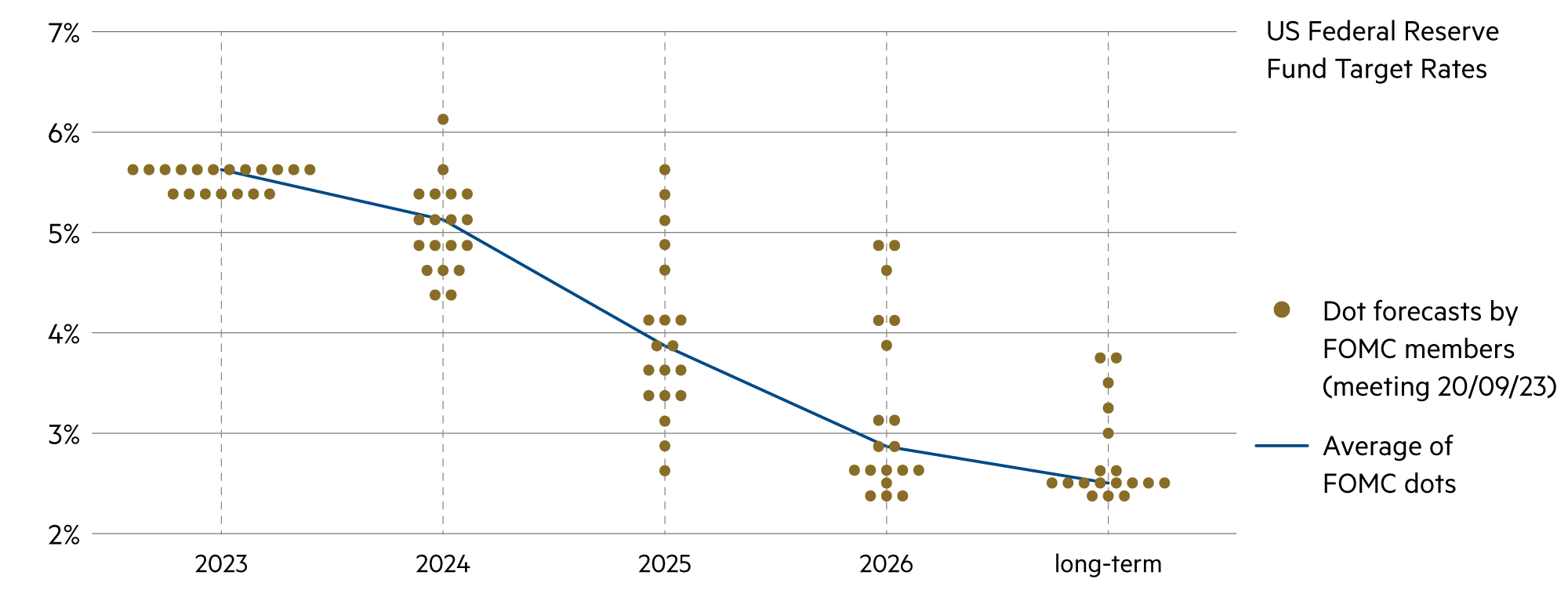

It remains unclear when U.S. Fed fund rates will fall. But even the Federal Reserve’s Open Market Committee (FOMC), which has the power to decide on these key interest rates, forecasts a sharp drop over the next three years. The background to this is that PCE core inflation has come to a virtual standstill recently, a downside surprise from a 0.2% consensus call. The 3 month annualized reading fell to 2.2% in August. This should be constructive for US Treasuries and risk assets.

Read more Close

The Fed pursues a policy of “average inflation targeting” (AIT) and its restrictive stance has resulted in the latest inflation figures coming within the Fed’s AIT target range. As a result, the Fed’s policy makers expect a potential rate cut of around 300 basis points in the medium term. The current level of 5.5% is significantly higher than the Fed’s forecast for the end of 2025 (3.875%) and the end of 2026 (2.875%). Should the respective forecasts materialize, this would result in a strong recovery of bonds. However, a side effect for the franc investor would also be a severe depreciation of the dollar against the Swiss Franc.

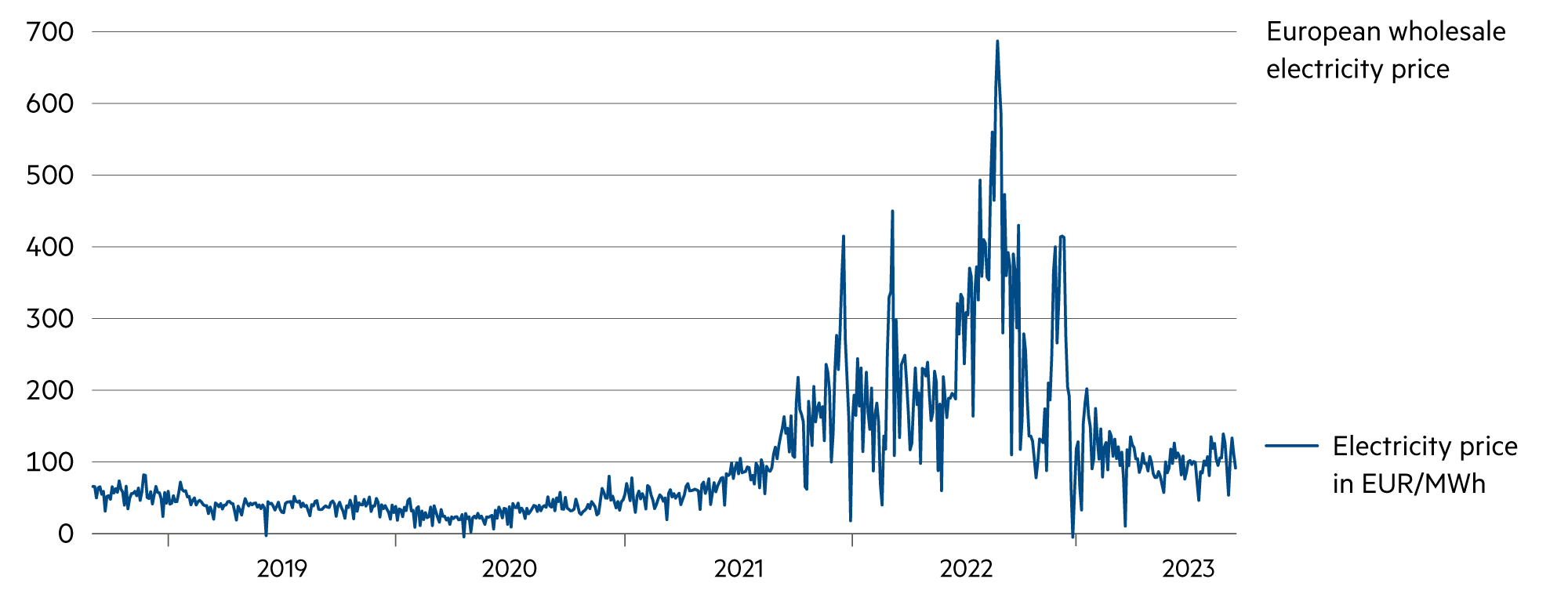

In Europe, too, a moderation of inflation is being observed across the board. However, we are still well short of the target. In the euro zone as a whole, inflation fell from 5.2% in August to 4.3% in September. There was a sharp decline in the momentum of service prices. Industrial goods excluding construction and energy in the euro area only achieved an annual increase of 1.6%. In May 2022, year-on-year growth was still at 16.0%.

Without new price shocks, overall inflation in the euro area will move toward the 2% target. In some euro area countries, the inflation rate is already negative (e.g. the Netherlands at -0.3%). In Belgium (+0.7%), it is not particularly high either. In the Netherlands, the sharp decline has to do with the fact that contracts for natural gas are often concluded at short notice.

Due to the Fed’s monetary policy signals to keep key interest rates high for longer, the dollar has recovered further. Most recently, it stood at 0.92 against the franc (+3.3% in one month, only -1.2% since the beginning of the year). At 0.97 against the franc, the euro also gained in September, but not as strongly (+1.1% in one month; -2.2% since the beginning of the year).

Both currency developments are providing tailwinds for Swiss companies whose sales or earnings are primarily generated in these currency areas. As most analysts have not yet priced in the dollar’s strong currency movement, many Swiss equities are likely to see a more positive assessment in the fourth quarter ahead of the 2023 financial statements.

| Asset class | 3–6 months | 12–24 months | Analysis |

|---|---|---|---|

| Bank account |

|

|

Those seeking sustainable returns above the inflation rate in Switzerland (+1.7%) should invest excess liquidity in a securities portfolio. |

| Euro / Swiss franc |

|

|

At 0.97, the exchange rate is within the range of realistic expectations for this currency pair, which is important for the Swiss economy. |

| US dollar / Swiss franc |

|

|

In the fourth quarter, U.S. GDP growth should still be positive, but rather weak. Accordingly, the dollar appreciation is likely to end. |

| Euro / US dollar |

|

|

At 1.05, the lowest value in the current year was measured at the end of September. Higher interest rates in the $ area attract more capital. |