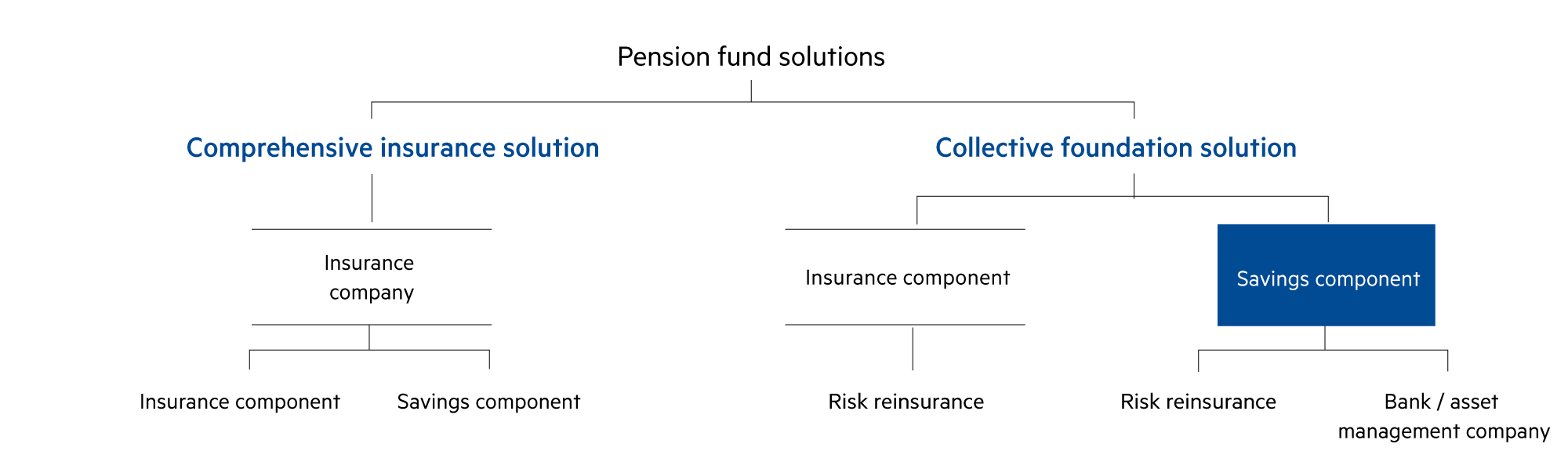

Semi-autonomous collective foundation

In practice, small and medium-sized enterprises often opt for a semi-autonomous collective foundation. Before deciding on a suitable solution, it is sensible to have an in-depth consultation.

In recent years, comprehensive insurance has become significantly more expensive for companies and insured persons. Due to the low interest rates, rising life expectancy, and regulatory investment requirements, comprehensive insurance providers struggle to generate the necessary returns. The result is high costs and low returns: the affiliated company does not benefit or hardly benefits at all from the development of the capital markets. This is why many SMEs today opt for a semi-autonomous collective foundation.

In the case of a semi-autonomous collective foundation solution, an insurance company provides cover against risks such as death and disability.

There are usually several insurance companies to choose from, which leads to attractive conditions. The management of the fixed assets (the savings component) is either handled by the collective foundation itself or delegated to a specialized asset management company. Ideally, the investment strategy can be jointly determined with a collective foundation. The insured persons have full transparency and benefit directly from the success of the investment.

Benefits

- Own pension fund

- Partially free choice of risk insurer

- Investment strategy jointly determined

- Direct earnings credits

- Lower risk and administrative costs

Disadvantages

- No interest or capital guarantee